Over the last month, our Senior Investment Analyst, Saniel Chandrawat, conducted an in-depth research trip to India, engaging with leaders from key sectors such as financials and healthcare, and conducting channel checks in stores. These interactions provide us with a nuanced understanding of India’s current economic landscape and emerging opportunities. Here, we share some of the key observations and insights from the trip.

India’s pharmaceutical landscape is undergoing a significant transformation, with companies strategically positioning themselves for higher-value opportunities. Our recent interactions with industry leaders highlight a clear shift from pure generic manufacturing to more complex, margin-accretive segments.

Mankind Pharma, a US$12 billion market cap company focused on the domestic market, exemplifies this evolution. Despite recent market headwinds, management’s strategic initiatives paint a promising picture. The company has completed a comprehensive restructuring of its sales force and over-the-counter (OTC) segment, with early results showing encouraging signs – the OTC segment has delivered ~25% growth in the quarters following the restructuring.1 The recent INR 137.7 billion (~US$1.6 billion) acquisition of Bharat Serums and Vaccines Limited (BSV), while causing temporary integration challenges, provides strategic entry into specialty segments like women’s healthcare and infertility treatments.2 Management expects margins to expand from current levels of ~26% to 30% over the next 3-4 years, driven by productivity improvements and international market expansion.3

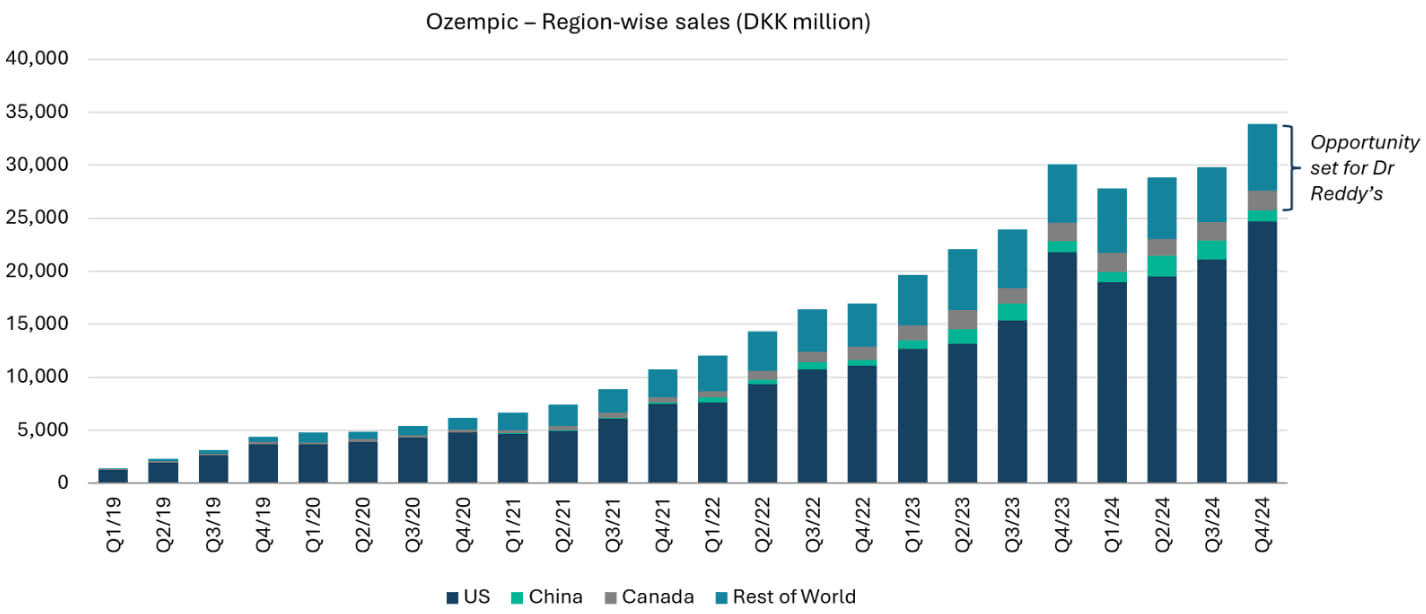

The sector’s evolution is perhaps most evident in the emerging GLP-1 opportunity. Dr. Reddy’s Laboratories is positioning itself as a key player in this space, leveraging its comprehensive capabilities across the value chain. Saniel met with Dr. Reddy’s Head of Emerging Markets and gained valuable insights into the company’s strategic preparations for their upcoming GLP-1 launch, as the Ozempic patent in certain key regions is set to expire in 2026. Dr. Reddy’s boasts end-to-end capabilities, including active pharmaceutical ingredient (API) production, formulations, and fill and finish, giving them a significant edge amid the global capacity shortage. With many Indian companies seeking their GLP-1 APIs, Dr. Reddy’s strong market presence ensures they can meet high demand while competitors may struggle. Additionally, their leading position in emerging markets outside India sets them up to capture substantial market share post-patent expiry.

Overall, companies advancing into specialty and complex generics are poised for premium valuations thanks to higher margins and reduced competition. Additionally, increased consolidation, exemplified by Mankind’s acquisition of BSV, creates avenues for financially strong firms to acquire complementary strengths. While short-term challenges such as margin pressures and competitive intensity remain, the longer-term outlook is positive for Indian pharmaceutical companies that are extending their innovation leadership to differentiate from the pack.

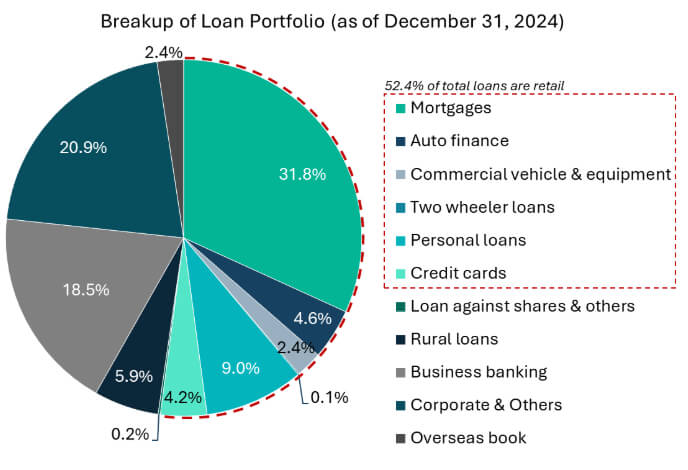

India’s banking sector slowdown has rolled through into 2025, though nuanced stress patterns across different lending segments are creating a unique environment where bank selection becomes increasingly critical. Our meetings with management teams of several leading private sector banks revealed important distinctions in their approach to growth and risk management during this period.

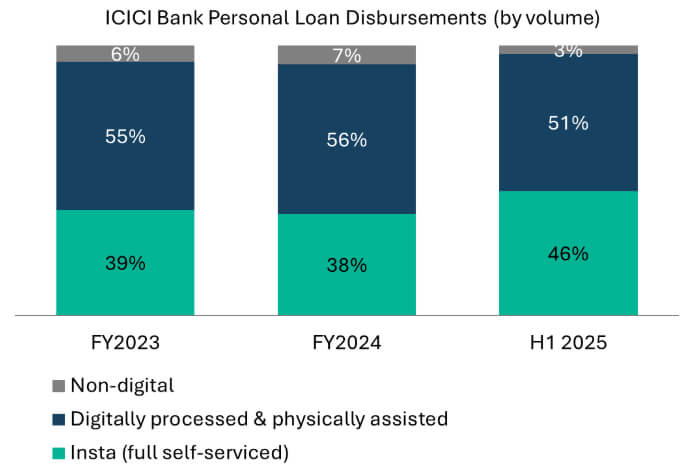

In particular, asset quality concerns were mentioned but with important segmental differences. Management at ICICI Bank highlighted that challenges in unsecured lending are primarily concentrated in high-yield segments (~18-19%) typically served by non-banking financial companies (NBFCs), while their personal loan book at 11% yields remains resilient.4 This view was partially echoed by Kotak Bank, which indicated stabilization in unsecured personal loans but noted that credit card stress may take longer to normalize. HDFC Bank took a more cautious stance, suggesting that asset quality issues could worsen before improving, potentially affecting multiple segments beyond just unsecured retail.

On the liability side, deposit competition remains intense. HDFC Bank acknowledged gaining deposit share but at higher costs. Kotak Bank also noted that funding costs continue to rise, but maintaining a 150bps gap between the savings and term deposit rates has influenced consumer behavior to keep money in savings. This dynamic is reshaping the competitive landscape, with banks’ ability to maintain current and savings account (CASA) ratios becoming increasingly dependent on digital capabilities and customer service rather than just rate differentials.

Growth trajectories among major banks are also diverging. HDFC Bank expects to underperform system credit growth in FY25 before returning to market-level growth in FY26 and outperformance in FY27. In contrast, ICICI Bank appears more optimistic, highlighting their relatively low market share (11-12% of system recurring pre-provision operating profit (PPOP)) against their higher share of incremental PPOP (17-18%).5 Management attributed this to structural improvements in the bank, including more streamlined internal reporting structures and enhanced technology-driven process efficiencies.

Looking ahead, we see key differentiation emerging in three areas: risk management capabilities (particularly in unsecured lending), deposit franchise strength, and operational efficiency improvements through technology adoption. Banks that excel in these areas are likely to command premium valuations, even as the sector navigates through the current credit cycle.

A significant highlight from Saniel’s trip was Mahindra and Mahindra’s (Mahindra) upcoming electric vehicle (EV) launches. The company is set to introduce two SUV models equipped with advanced features and a futuristic design, which has generated substantial customer interest in showrooms. This enthusiasm reflects the broader trend in India’s passenger vehicle market, where government incentives and premiumization are beginning to drive a robust shift towards EV adoption.

Saniel visited Mahindra’s Andheri West showroom in Mumbai to test drive the company’s latest two flagship models: the XEV 9e and BE6, priced at INR 3.1 million (~US$35,400) and INR 2.7 million (~US$31,200), respectively.6 Both models feature battery options up to an impressive 500km range, advanced driver assistance systems (ADAS Level 2++) including auto-parking functionality, and sporty, futuristic designs. With these latest models, Mahindra competes with global players like Tesla (not yet in India) and BYD by offering affordable premium EVs tailored to emerging markets. However, while Tesla focuses on cutting-edge autonomous technology and BYD excels in battery innovation and cost efficiency through vertical integration, Mahindra’s EVs emphasize design innovation, affordability, and market-specific adaptability, positioning them as strong contenders in price-sensitive and growing EV markets like India.

What stood out to us from this trip is the increasing sophistication of Indian companies in pursuing innovation-led growth, whether it’s pharmaceutical companies evolving beyond generic manufacturing or automakers developing a new range of EVs. This shift in focus from pure cost advantage to building an innovation advantage is noteworthy as it suggests a widening of competitive moats for companies at the forefront of such investments. Overall, we remain optimistic about India’s long-term structural growth story, with our recent visit reinforcing our conviction in the fundamental capabilities these leading companies have built. Thus, we would view recent market pullbacks as attractive entry points for certain high-conviction stocks.

The information presented in the material is not and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP (“Shikhara”) is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.