Our Senior Investment Analyst, Marcus Chu, traveled across China over the last few weeks, engaging with over 25 companies and industry experts in autos, industrials, materials, and more. His on-the-ground observations reveal a nuanced picture: while targeted policy measures are showing early signs of effectiveness, the broader economic transition remains uneven. Notable bright spots emerged in the auto parts and smart technologies, but caution remains in certain segments of the property and materials sectors.

While global investors remain skeptical of China’s economic trajectory, our recent on-the-ground visits across multiple cities reveal that Beijing’s targeted policy measures are delivering better-than-expected results. Rather than massive stimulus packages, it’s the targeted implementation and public responsiveness that’s slowly but surely making a difference.

The property sector offers a clear example of this dynamic. During our visits to both luxury developments in Shanghai and mid-range projects in Hangzhou, we observed how specific policy measures are helping stabilize both transaction volumes and prices. In Hangzhou, for instance, the relaxation of purchase restrictions has successfully increased non-local buyer participation from 5% to 15%.1 Similarly, the government’s “whitelist” approach for developer financing is showing results – as noted by Bank of Communications, about 90% of the 300+ projects in the program have received approval, with 80-85% already securing funding.2 Elsewhere, the manufactured goods subsidy program was also cited in discussions as being useful in supporting sales.

A key factor often overlooked by international observers is the high degree of public compliance with government initiatives. As one property expert noted, this coordination between policy and public response helps explain why even modest measures can have a meaningful impact. For investors, this suggests opportunities may lie not in waiting for massive stimulus, but in identifying sectors and companies that benefit from targeted policy support and efficient implementation.

Despite the above, there is a huge divergence in China’s property market recovery. Our site visits and expert meetings reveal a clear bifurcation between premium segments in tier-1 and 2 cities against the rest of the market.

In Shanghai’s luxury segment, while sales velocity is slower, pricing power remains intact. During our visit to a Poly Development project, management reported maintaining average selling prices at premium levels, with 50% of units sold – slower than historical norms but still broadly meeting market expectations.3 In Hangzhou, the demand appears even more robust thanks to price limits, with one mid-range project attracting 400 buyers for just 60 units.

However, this recovery story isn’t uniform across the country. Property experts we met emphasized that tier-3 and tier-4 cities continue to face significant challenges, including high inventory levels, declining quality in primary markets, and weak demand. Secondary markets show some resilience, but price cuts and delivery risks persist.

Overall, it’s positive that we’re seeing signs of stabilization in the top-tier cities and that developers’ risks are generally getting lower. The near-term outlook appears to be optimistic, with early-year data exceeding expectations. However, the full-year perspective may hinge on the government’s willingness to implement additional stimulus measures should any data weaknesses arise.

Fueled by cutting-edge robotics and a surge in smart driving technologies, China’s manufacturing industry is a highly interesting space to watch. Marcus attended several industrial automation and auto parts supply chain meetings and highlighted the burgeoning opportunities within this sector, underscoring China’s strategic push towards advanced manufacturing innovations.

Robotics integration in auto manufacturing: Leading domestic suppliers are rapidly moving up the value chain through smart driving features and robotics. Tuopu, a leading Chinese auto parts manufacturer (specializing in chassis systems, powertrain mounts, and interior components) exemplifies this trend, having increased its content value per vehicle from RMB 10,000 in traditional partnerships to RMB 30,000 with Huawei.4 The company’s expansion into humanoid robotics, particularly through its Tesla collaboration, marks its entry into higher-value manufacturing. The development of robotic components, such as actuators and execution units, not only improves production capabilities but also supports the integration of more advanced features in vehicles.

This transformation is not unique to auto parts suppliers but extends to the broader industrial automation sector, as we observed during our visit to Estun’s facilities. Estun Automation, a Chinese industrial robotics manufacturer, is developing its robotics capabilities, especially in automotive applications, where they serve industry giants like BYD and CATL. While touring their production lines, we observed their strategic pivot toward higher-value segments like spot welding, though our discussions with management revealed the challenges they face in matching the consistency and quality standards of international competitors.

Smart driving technologies and beyond: Smart driving components represent a particularly promising segment, with the penetration of high-end autonomous driving assistance systems (ADAS) features expected to increase rapidly. In our discussion with Horizon Robotics, a Chinese AI chip designer focusing on autonomous driving solutions, management projected high-end ADAS penetration to surge from current levels of 16-17% to 50-70%.5 This growth is driven by increasing sophistication in autonomous driving capabilities and the competitive landscape between domestic and international players. Notably, Horizon Robotics, which currently has a dominant market share in the low-end segment, will see its chips evaluated alongside Nvidia’s in BYD’s mid-range vehicles later this year. This marks the first opportunity for automakers to assess performance differences between the two companies’ chips in mid-range smart driving applications – a crucial reference point as auto brands select suppliers for their next wave of models.

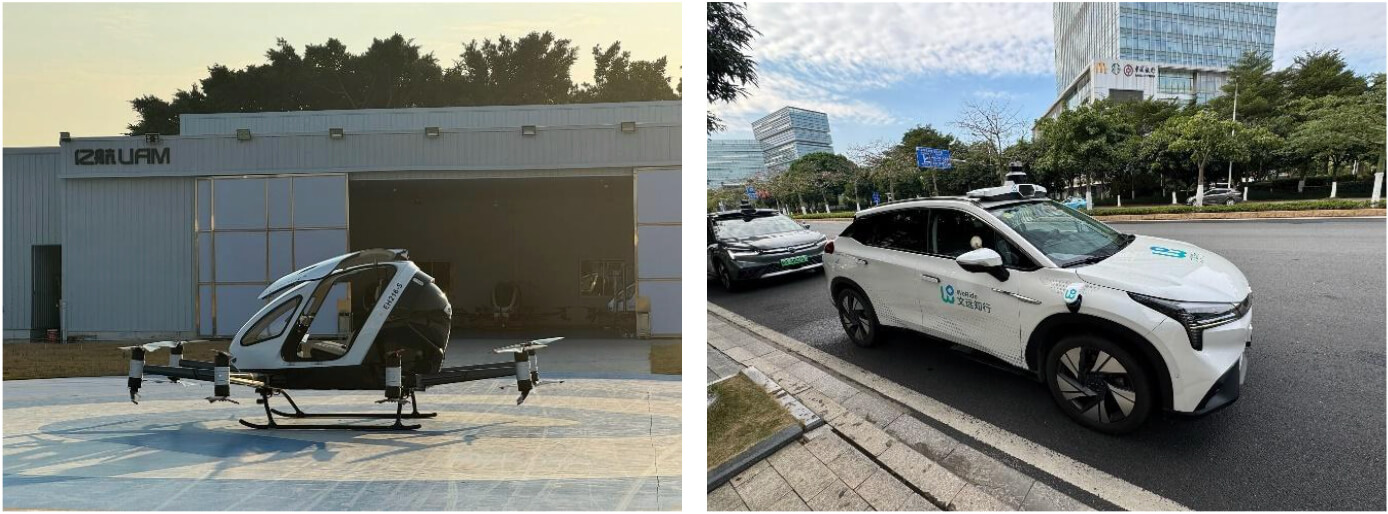

The level of automotive innovation is increasingly evident in emerging transportation solutions. At a recent industry conference, Marcus witnessed impressive demonstrations of EHang’s autonomous aerial vehicles (AAVs), which are pioneering urban air mobility in China with their passenger-grade drones operating at low altitudes. Similarly, WeRide’s autonomous ride-hailing vehicles showcased the practical implementation of advanced ADAS and smart driving technologies, with their robotaxis already operating in several Chinese cities. These real-world applications demonstrate how automotive innovations are being applied and can create additional growth opportunities for suppliers who can meet the demanding specifications of these next-generation vehicles.

Despite early-year performance exceeding forecasts, industry experts point to a bearish demand outlook for the rest of 2025. During meetings with management teams and industry specialists, a consistent theme emerged around sustained demand weakness across multiple sectors, though with varying degrees of impact.

Steel industry supply-side reforms: While China’s steel industry faces headwinds from softening property demand, a new wave of supply-side reform could reshape the sector’s dynamics. During our recent meetings with industry leaders and experts, discussions centered around potential capacity reduction initiatives and industry consolidation. Market speculation suggests a targeted reduction of 50 million tons in capacity, though execution appears more complex than the 2018 reforms where most closures were small and unqualified capacity.

Against this backdrop, leading producers like Baosteel, one of China’s largest steel manufacturers, are responding with enhanced operational discipline. Baosteel is tightening its inventory management, further reducing iron ore stocks from two months to one month to alleviate cash flow pressures. This focus on working capital efficiency, combined with strategic positioning in higher-value segments like cold-rolled products, demonstrates the industry’s adaptation to challenging market conditions.

Solar sector continues its slow transition: China’s solar industry faces a prolonged period of oversupply, with industry experts suggesting a recovery may not materialize until late 2026 or 2027. Our discussions with solar materials specialists revealed a sector grappling with aggressive capacity expansion amid weakening profitability across the value chain. Despite government attempts to manage supply through production quotas, new capacity continues to enter the market.

It’s worth noting that the near-term demand spikes are expected to be driven by upcoming policy changes in tariff structures. Residential installations are expected to surge to 4GW monthly from March to May before dropping to 1-2GW.6 Commercial and industrial segments face similar volatility, with 20GW of projects requiring approval before December.7 But overall, this challenging environment warrants caution. While selective opportunities may exist in market leaders with strong cost positions, broad sector recovery still appears distant.

While China’s economic transition presents challenges, particularly in the property and materials sectors, there are pockets of dynamism in areas benefiting from the country’s technological advancement push. We see, manufacturing, especially in the auto parts and industrial automation sectors, stands out, with domestic companies moving up the value chain through smart driving technologies and robotics integration. This evolution from pure manufacturing to innovation-driven growth suggests selective opportunities exist for investors who can identify companies successfully navigating China’s policy-supported transformation, despite any broader macro headwinds.

The information presented in the material is not and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP (“Shikhara”) is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.