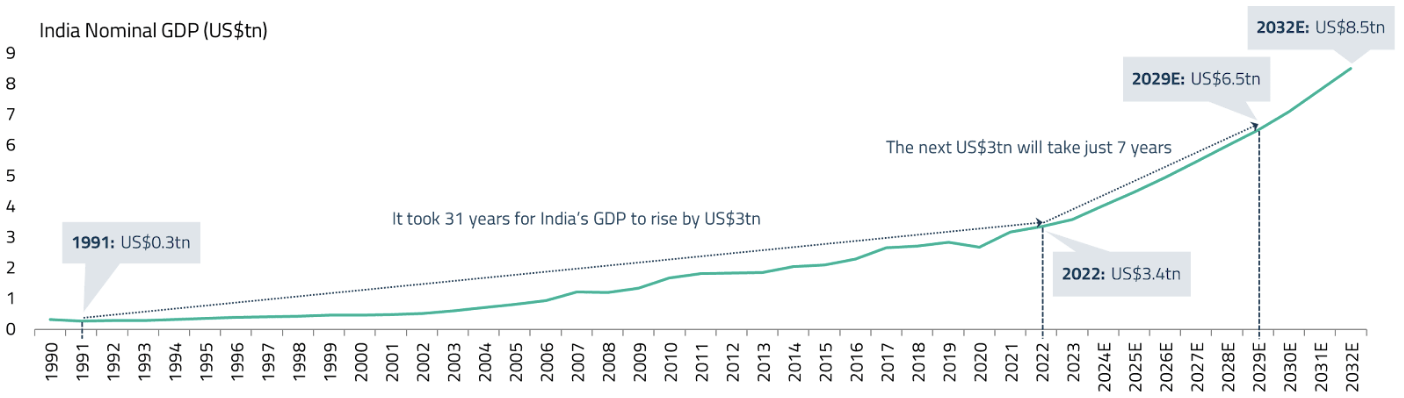

In a demand-constrained global economy, India is emerging as a bright spot—a nation whose robust internal market, demographic strength, and strategic policy shifts are transforming it from a potential growth story into a current global leader. As countries grapple with inflationary pressures, geopolitical fragmentation, and volatile commodity cycles, India offers a rare combination of macroeconomic stability, structural reform momentum, and digital-first transformation. This white paper explores why India is not just an alternative to China but is becoming the primary destination for long-term capital, innovation, and industrial diversification.

India’s most compelling economic feature lies in the depth and breadth of its domestic demand. Unlike traditional export-dependent economies, India has built a growth engine powered by consumption from its vast and youthful population. Household consumption contributes to over 60% of GDP, and this trend continues to accelerate as wage growth rises in both urban and rural sectors.1 The increase in middle-class incomes, coupled with improved job opportunities through expanding service and industrial sectors, is reinforcing a virtuous cycle of demand-led growth.

India, exemplifies this internal momentum. The rise of hospital chains and medical infrastructure investments reflects the growing purchasing power and aspirations of Indian consumers. A surge in demand for preventive care, diagnostic labs, and specialized treatment centers has drawn significant interest from both domestic and foreign investors. Moreover, government initiatives such as Ayushman Bharat have widened access to healthcare, particularly in underserved rural regions. This combination of public investment and private innovation is scaling healthcare delivery and creating large-scale employment in a sector that is expected to grow to USD 638 billion in 2025.2

Simultaneously, the growth of Global Capability Centers (GCCs) in cities like Bengaluru, Hyderabad, Gurugram, and Pune is creating high-value, skilled employment, further stimulating the economy.

India’s macroeconomic fundamentals have strengthened significantly in recent years. Inflation has moderated to manageable levels, helping anchor consumer confidence and investment activity. The Reserve Bank of India’s calibrated monetary policy and the government’s fiscal prudence have ensured a stable policy environment conducive to long-term planning.

Importantly, India has been strategically positioned to benefit from the global realignment of supply chains. The “China+1” strategy, increasingly adopted by multinational corporations, seeks to reduce over-reliance on China by diversifying operations. India, with its large labor pool, improving logistics, and business-friendly reforms, is now the most credible alternative. Major global manufacturers, including Apple and Samsung, are already shifting production lines to Indian soil, signaling confidence in the country’s industrial future.

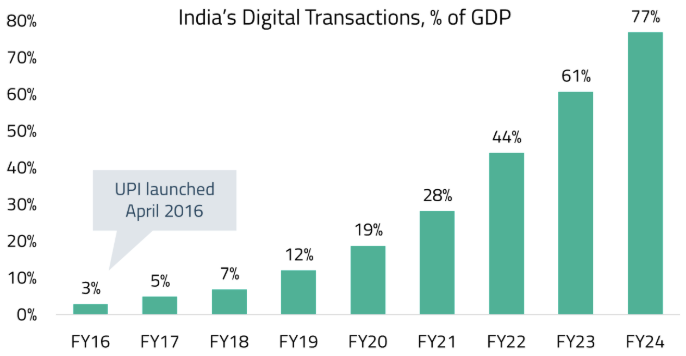

One of India’s most transformative achievements is the rapid formalization and digitization of its economy. The government’s push toward inclusive digital infrastructure has created the foundation for scalable, tech-enabled growth. At the heart of this transformation is the Aadhaar program—a universal biometric ID system that now covers over 95% of India’s total population.3 This has facilitated the opening of more than 500 million new bank accounts, a level of financial inclusion unmatched globally.4

Unified Payments Interface (UPI), a public digital payment platform, has revolutionized India’s consumer transaction landscape. Today, UPI handles eight times more transactions than all debit and credit cards combined.5 This digital leapfrogging enables even the smallest businesses and rural consumers to participate in the formal economy, laying the groundwork for consistent, scalable economic growth.

With the introduction of the Goods and Services Tax (GST), India has seen a marked shift in economic formalization. More companies are registering and paying taxes, contributing to improved compliance and expanding the government’s ability to reinvest in infrastructure. These shifts have also opened doors to formal credit, enabling small and medium enterprises to scale operations.

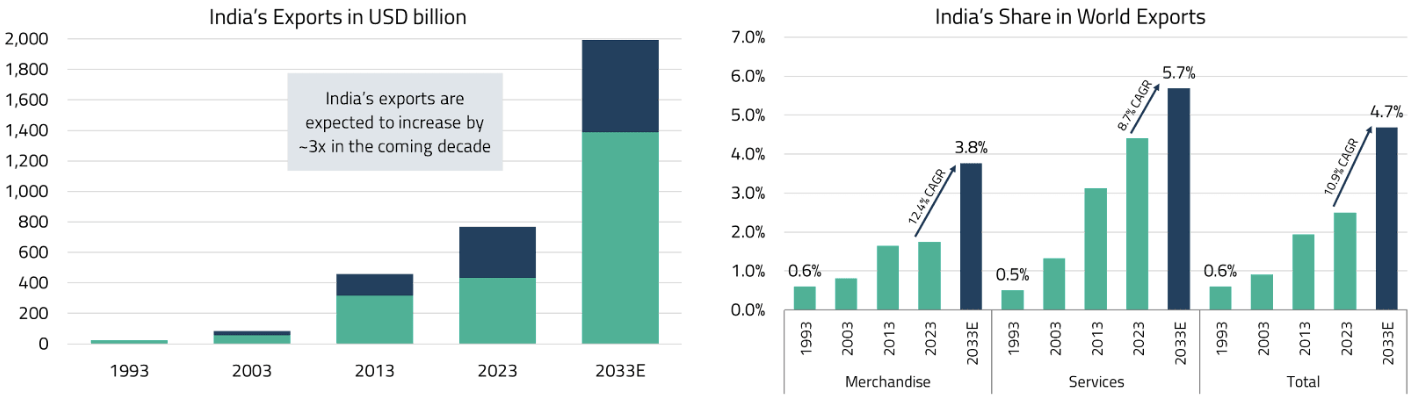

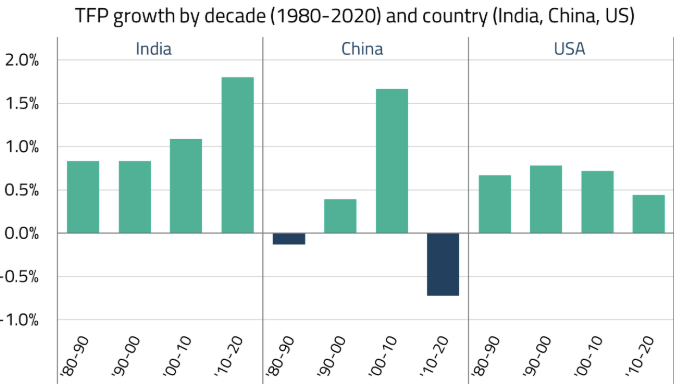

India’s Total Factor Productivity (TFP) is now growing at 1.5% annually, boosted by technology adoption and regulatory reforms.6 Moreover, the share of exports is expected to grow from 1.9% to 4.7% by 2033, driven by electronics, pharmaceuticals, and industrial goods.7 The confluence of formalization, rising productivity, expanding exports, and wage growth is establishing a long-term growth engine capable of delivering 6-8% real GDP growth consistently.8

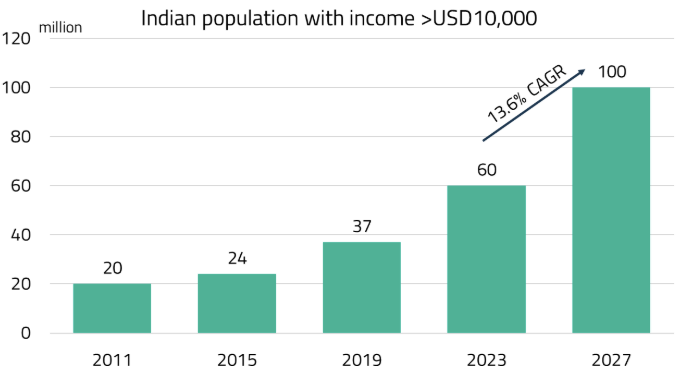

India’s consumption story is evolving from basic needs to aspirational lifestyles. Today, only about 4% of India’s working-age population earns over USD 10,000 annually, but this segment has grown at a 12.6% CAGR over FY19-23.9 This expanding mass-premium cohort is driving demand in sectors such as jewelry, healthcare, real estate, travel, and personal electronics.

As disposable incomes increase, consumers are shifting toward premium brands and experiences, offering lucrative opportunities for companies with strong brand equity and distribution networks. Businesses that can deliver differentiated, high-quality products and services in India stand to benefit from one of the largest and fastest-growing consumer markets in the world.

The Indian government’s commitment to infrastructure-led growth is manifesting in a historic capex push. With over USD 1.3 trillion planned investments across transport, energy, defense, and water infrastructure through FY27, the scale is unprecedented.10 This has a twofold impact: it creates jobs in the short term while reducing structural bottlenecks in the long term.

Railways, in particular, are undergoing a massive transformation. The government plans to invest USD 136 billion over the next five years to expand rail corridors and modernize logistics.11 These investments are expected to increase capacity by 200% and lower transportation costs by up to 30%, enhancing India’s competitiveness in global manufacturing.12

India’s manufacturing sector is poised for a renaissance. Aided by the Production-Linked Incentive (PLI) schemes and the ongoing shift in global supply chains, India is becoming a viable hub for electronics, pharmaceuticals, textiles, and automotive manufacturing. States such as Tamil Nadu, Gujarat, and Maharashtra are emerging as industrial powerhouses, supported by modern ports, efficient freight corridors, and investor-friendly policies. Manufacturing’s contribution to GDP is projected to rise significantly over the next decade, adding millions of new jobs and deepening India’s integration into global value chains.

In parallel, the push toward green energy is gaining momentum. India is aggressively investing in renewables, green hydrogen, ethanol, and electric vehicles. The country’s leadership in solar capacity and commitment to energy transition not only addresses environmental concerns but also ensures energy security.

India’s growing middle class is not just saving more—it is spending more. Travel and tourism are witnessing a surge, driven by increased disposable income and supportive government schemes. India’s online consumer spend is projected to more than 6x its size from USD 110 billion in 2022 to USD 710 billion in 2030.13 Notably, travel is the second-largest digital spending category after e-commerce.14

The government is playing a key enabling role by improving regional air connectivity, upgrading tourist infrastructure, and promoting lesser-known destinations. Spiritual and heritage tourism, driven by India’s rich cultural tapestry, is also being strategically marketed to international audiences. As more Indian citizens explore both domestic and international travel, the tourism sector is expected to become a USD 500 billion industry by 2030, contributing meaningfully to employment and GDP growth.15 These trends are not only generating economic activity but are also elevating India’s soft power on the global stage.

In a world of volatility, India offers relative predictability and resilience. Falling oil prices, to which India is highly sensitive as a net importer, help narrow the current account deficit and ease inflationary pressures. Simultaneously, foreign investors, who had been underweight in Indian equities, are increasingly looking at the market as a safe haven with high return potential.

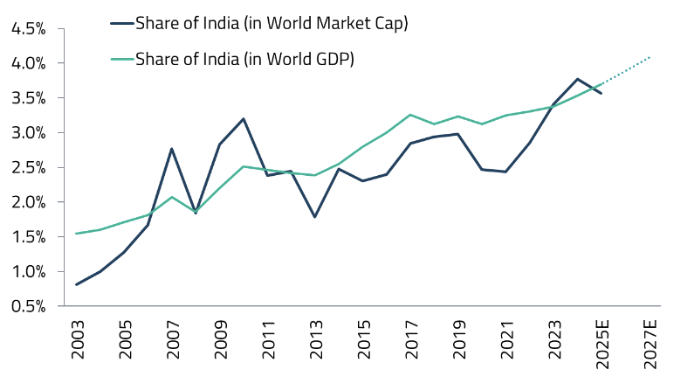

Indian equities have historically traded at a premium to emerging markets, and this premium has expanded further as China faces a structural de-rating. From a mere 8.3% in 2016, India’s weight in the MSCI Emerging Markets Index has grown to 19.4% in 2024, reflecting global recognition of India’s growing importance.16

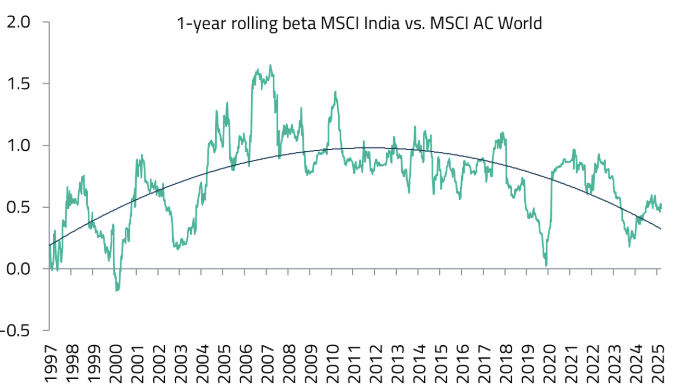

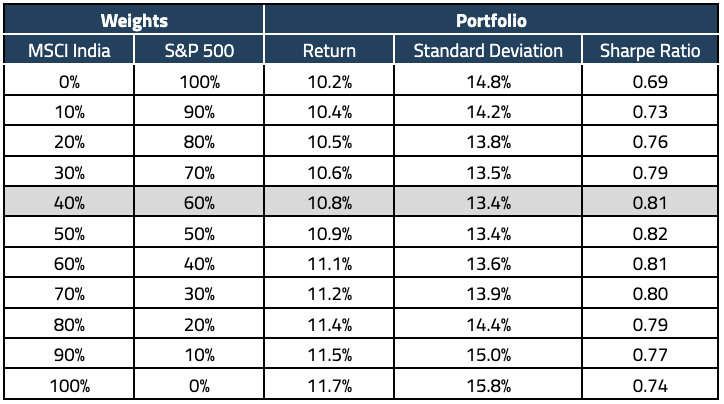

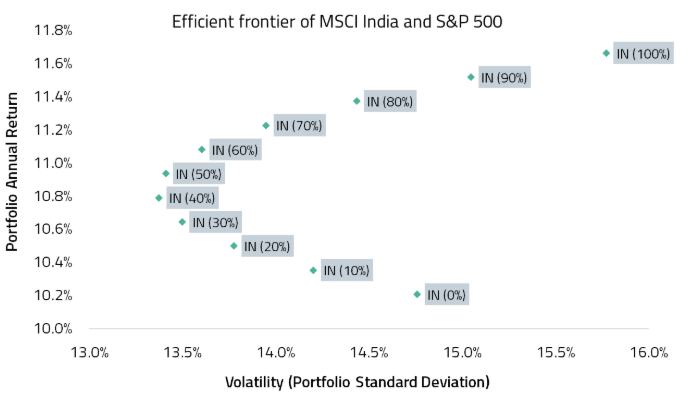

Investing in India offers compelling diversification benefits for those looking to diversify away from US markets. An analysis of MSCI India and S&P 500 returns between January 2014 and April 2025 demonstrates three key advantages.

First, adding India exposure enhances portfolio returns. While a pure S&P 500 portfolio delivered strong annualized returns of 10.2% during the period, incorporating a 40% allocation to India boosted returns by 60 basis points to 10.8% pa. This outperformance is particularly noteworthy, given that the S&P 500 has been among the top-performing indices globally over this period.

Second, and perhaps counterintuitively, adding India reduces portfolio risk. Despite India’s market being traditionally viewed as a more volatile emerging market, the optimal portfolio (40% India and 60% S&P 500) actually reduced overall portfolio volatility. The standard deviation decreased from 14.8% to 13.4%, demonstrating the powerful effect of diversification when combining markets with low correlation.

Finally, this combination created better risk-adjusted returns. With a 40% allocation to MSCI India, the portfolio efficiency improves significantly, with the Sharpe ratio increasing from 0.69 (100% S&P 500) to 0.81 (40/60 split). Although future returns may differ, this track record suggests that adding India exposure to a US portfolio could be a prudent diversification move for investors seeking opportunities beyond the US market.

India is not a future bet—it is a present imperative. The confluence of favorable demographics, resilient domestic demand, improving infrastructure, digital transformation, and policy consistency make it a uniquely attractive investment destination in an uncertain global landscape.

For global investors, India represents not just a source of returns, but a hedge against stagnation elsewhere. For entrepreneurs, it is a proving ground for scalable innovation. For corporations, it is the last great frontier of consumer and industrial growth. The time to act is now—India is ready.

For sophisticated investors only. For informational purposes only. The information presented in the material is not and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP (“Shikhara”) is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. The information and any opinions contained in this document have been obtained from sources that Shikhara considers reliable, but Shikhara does not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. Furthermore, all opinions are current only as of the date of distribution are subject to change without notice. Shikhara does not have any obligation to provide revised opinions in the event of changed circumstances. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.