As global markets digest the recent tariff events, our report for Q1 explores why this disruption might actually accelerate a necessary economic rebalancing, one where India finds itself uniquely positioned to benefit. While near-term market turbulence is inevitable, India’s dual advantage as both a manufacturing hub and a massive consumer market could prove decisive in this new world order. Below, we break down why India might be just in the right place at the right time, and how we’re positioning our portfolio to capture this transition. We hope you find these insights helpful in navigating these dynamic times.

Indian equities surged in March, with the MSCI India Index up 9.40% (in USD terms1) after five consecutive months of decline. This reduced the contraction seen YTD, bringing Q1 returns to -2.90%. The March rally was fueled by a turnaround in foreign investor inflows, with foreign institutional investors (FIIs) recording net inflows of USD 0.2 billion in March. However, FII outflows from Indian equities for the calendar year YTD stand at USD 13.5 billion (vs USD 0.8 billion the same time last year).2

Aside from IT, which was flattish for the month, all sectors saw solid returns in March, with Utilities and Industrials leading the rally. On a quarterly basis, Materials and Financials were the relative outperformers, while Real Estate and IT were the laggards.

Key macroeconomic indicators for March were mixed but show an improving trend at an aggregate level for the quarter. Goods and Services Tax (GST) collections accelerated to INR 1.96 trillion (~USD 22.7 billion) in March, up 9.9% y/y (vs 9.1% y/y in February).3 But central government capex spending remained subdued, rising at a softer pace of INR 545 billion in February (vs INR 720 billion in January).4

Manufacturing purchasing managers’ index (PMI) rose to an 8-month high of 58.1 in March (vs 56.3 in February), as factory orders and production activity grew.5 Strong demand, likely to front-run tariffs, led companies to tap into their inventories to meet increased orders, resulting in the most rapid decline in finished goods stock in over three years. On the services side, services PMI softened by 0.5pts to 58.5 in March but remained robust.6 Growth was seen across all service subsectors, led by Finance and Insurance, though international sales showed signs of weaker growth. Meanwhile, consumer price inflation showed signs of cooling, easing to a 7-month low of 3.6% y/y in February (vs 4.3% in January), helped by easing food prices, which have remained elevated for some time.

Policymakers have started to take a stimulative approach this quarter in a bid to boost consumption growth. In the FY26 Union Budget presented in February, the Indian Finance Minister shifted the focus of fiscal policy towards consumption from a predominantly capex orientation, with INR 1 trillion of personal income tax stimulus for taxpayers.

The recent trade actions by the US administration, while shocking markets, could mark the beginning of a necessary global economic rebalancing. While immediate market reactions reflect uncertainty, we see a more nuanced picture emerging – one that potentially leads to a vastly different, but perhaps more sustainable global economic order. For India, the country appears to be at the right place, at the right time.

To understand the current situation, we must acknowledge that over the past two decades, the global investment landscape has been significantly shaped by China’s remarkable integration into the world economy. Since joining the World Trade Organization (WTO) in 2001, China embarked on an aggressive investment trajectory, particularly post the 2008 global financial crisis (GFC), leading to substantial overinvestment relative to the rest of the world.

This period saw China become a manufacturing powerhouse, supported by extensive infrastructure projects and export-oriented policies. But while China built vast industrial complexes, sometimes even resulting in excess capacity, Western nations experienced a systematic dismantling of their industrial base. This wasn’t simply about losing factories; it meant the erosion of entire industrial ecosystems, including supplier networks, technical expertise, and manufacturing know-how, which has become all the more evident with the latest developments in high-tech sectors like AI, robotics, and automation.

Correcting these distortions requires a complex and likely painful rebalancing process. China needs to shift its focus toward domestic consumption, while Western economies must rebuild their industrial bases and redirect capital toward productive investment. While the process may create near-term economic headwinds, one could argue that it’s essential for establishing a more sustainable and resilient global economic order. And tariffs were perhaps just the necessary catalyst.

From a US perspective, the current administration has set out to achieve two things: 1) to reindustrialize the US and rebalance bilateral trade flows, and 2) to reduce the fiscal deficit and create a more efficient government. On the former, while the latest implementation of tariffs may seem aggressive, the underlying message is clear – countries willing to invest in US manufacturing capacity may find themselves subject to more favorable trade terms. This carrot-and-stick approach, while disruptive in the short term, could catalyze a much-needed rebalancing of global trade and investment flows. By imposing tariffs, the US is taking proactive steps to mitigate its unsustainable trade deficit and reduce dependency on cheap imports.

On the latter objective, the post-GFC era saw significant expansion of government regulation and spending, creating what many view as bureaucratic bloat. The current administration’s focus on deregulation and spending efficiency, while potentially slowing near-term growth, could lead to a leaner, more competitive economy. The good news is that, unlike the 2008 financial crisis, US households aren’t burdened with excessive debt. Thus, the country’s likely economic downturn, driven by a slowdown in consumer spending, should be relatively mild and short-lived.

For corporate America, most large businesses are well-positioned to weather this period of transition, potentially 1-2 quarters of uncertainty. Moreover, there’s a growing recognition among corporate leaders that the era of concentrated supply chains, particularly the heavy reliance on sourcing from China, is ending. This isn’t merely a reaction to current policies – it reflects a deeper understanding that supply chain diversification and domestic manufacturing capabilities are growing strategic imperatives. This transition will no doubt require significant capital expenditure and investment.

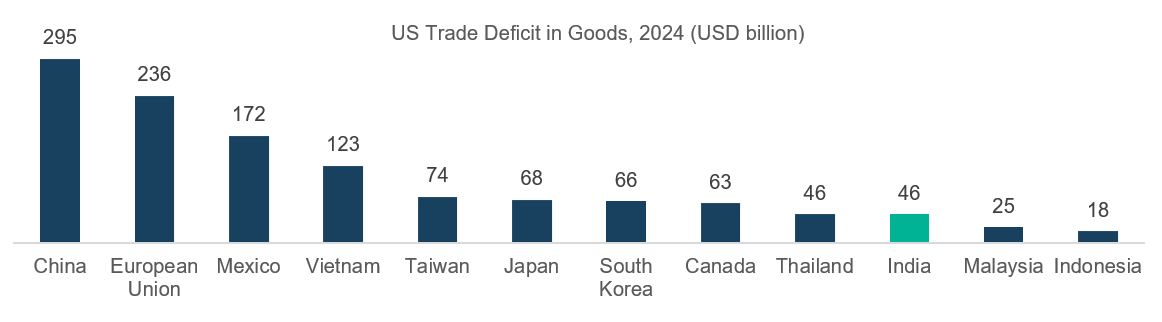

India is uniquely positioned in this global economic transition, primarily due to its dual advantage as both a manufacturing destination and a massive consumer market. Unlike previous manufacturing shifts from China and Korea to ASEAN countries, where their smaller markets ultimately led to the current tariffs based on trade deficits, the next wave of manufacturing is moving to India. India’s large and growing domestic market creates a natural trade equilibrium. This balance allows for sustained export growth while maintaining significant import capacity from the US, potentially shielding it from future tariff pressures. In contrast, the US had a US$123 billion trade deficit with Vietnam in 2024, which was one of the hardest hit by tariffs on ‘Liberation Day’.7 This is the new world that we’re operating in – where the size of a country’s domestic market determines its export potential – and that is a huge advantage to India.

This trend is already taking effect. Apple, for instance, plans to increase iPhone shipments to the US from India to mitigate the higher tariff costs. Despite a 26% tariff on Indian goods, producing in India remains more cost-effective than facing higher tariffs in China or manufacturing domestically in the US. As Apple continues to expand its production and assembly operations in India, we anticipate similar moves from other major companies.

This is something I also saw while traveling across Asia in the past few weeks – leading Asian companies actively exploring investment opportunities in India. Our meetings in Seoul were particularly telling, with discussions seeking our insights on navigating Indian markets and establishing local operations. This interest mirrors what we’ve seen with Apple and extends beyond Korea – Chinese and Japanese corporations are also showing similar enthusiasm. While we’ve had some recent concerns about AI’s potential impact on India’s employment landscape, this manufacturing momentum is something that can meaningfully boost job creation as India gets a greater share of Foreign Direct Investments (FDI).

From an economic perspective, India has significantly strengthened its position, with the fiscal deficit narrowing from 6.4% of GDP in FY23 to an estimated 4.8% for FY25, through disciplined spending and robust tax collections.8 Meanwhile, the Balance of Payments, which has been an Achilles heel in the past, has turned positive, powered by surging service exports from Global Capability Centers (GCCs). These tech and business service hubs, which have expanded rapidly post-COVID, now contribute over US$60 billion annually in exports, helping offset trade deficits and providing a stable foreign exchange buffer.9

Furthermore, the curtailing of unsecured retail credit, a significant concern over the last 4-5 years, is now behind us, and we see signals of an upward trend in the economic cycle. And let’s not forget that in a growth-constrained world, with major economies each grappling with their own unique challenges, India’s growth story stands out with its superior relative growth potential.

We’re taking a proactive approach across our portfolio, actively engaging with companies on the ground. Our focus has been on addressing tariff uncertainty head-on, working with companies to ensure they’re prepared for this evolving environment. Although challenges will lie ahead for all, the companies that can excel now will outperform their peers. Our meetings spanned sectors including consumer, quick commerce, renewables, hospitals, travel, and tourism. What’s striking is the prevailing sense of optimism despite potential tariff headwinds. The sentiment appears to be that while tariff impacts will obviously be negative globally, India’s relative advantages position it favorably in this landscape.

In positioning our portfolio for India’s expanding role in the global economy, we are focusing on four areas that offer both resilience and growth potential.

We expect this disruption to present compelling buying opportunities, as markets digest the initial shock of trade tensions. While this period of uncertainty may trigger a temporary de-rating across portions of our portfolio, we view this as a chance to build positions at attractive valuations. Our balanced approach of identifying the best-in-class across sectors allows us to capture India’s domestic growth story while positioning for evolving global trade dynamics.

Each quarter, we highlight a compelling theme or opportunity poised to shape the next decade. In previous editions, we have explored healthcare outsourcing, financial services, and India’s expanding manufacturing footprint. This quarter, our focus is on the growth opportunity of Indian hospitals in an underserved market.

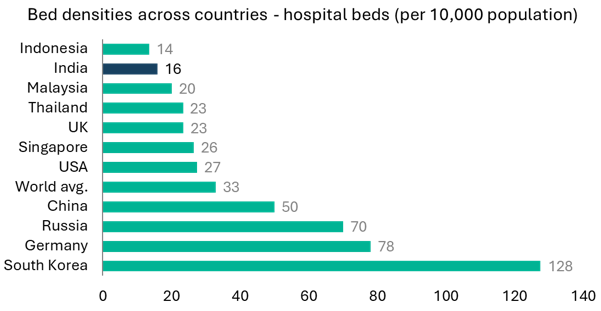

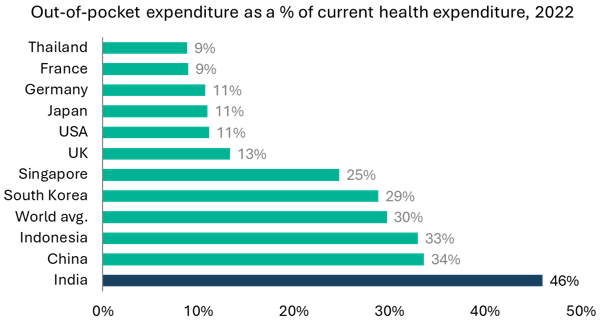

India has seen a consistent improvement in its healthcare infrastructure over the past decades, but it remains an underserved market. With one of the lowest hospital bed densities in the world, there’s a clear gap. While public healthcare spending has increased yearly, it falls short of global standards, leaving the system predominantly privately funded through rising disposable incomes.

My recent trip to India highlighted this demand growth. At Medanta in Gurgaon, a prominent Indian mass market hospital group, the hospital was completely packed. Since its establishment in 2009, Medanta has expanded to other cities in India and garnered phenomenal traction. This pattern of growth is also evident in Fortis Healthcare, which has shown substantial operational improvements since its backing by IHH Healthcare, a pan-Asian healthcare group. Under IHH’s influence, Fortis has achieved meaningful gains in both occupancy rates and hospital EBITDA margins over the past 3-4 years. These examples underscore a key investment thesis for Indian healthcare: when backed by strong execution capabilities and a clear value proposition, there is abundant demand for quality, affordable healthcare services.

On a more personal note, while in Gurgaon, I visited a local diagnostics center for an MRI (minor sports injury on the leg). In speaking with the operator, I discovered that the MRI services operate from 6AM in the morning until late into the night, back-to-back with minimal breaks – as my scan was done, the next patient was on their way in. With hospitals and diagnostic centers operating at full capacity, this underscores the tremendous potential for scaling India’s healthcare infrastructure and addressing unmet needs.

On the flip side, there has been some concern about the increase in hospital bed counts, with many institutions expanding or announcing expansions of 20–30% in recent years. However, we think India’s large and aging population inherently drives a higher demand for healthcare services. Additionally, akin to other developed economies, India is witnessing a rise in lifestyle diseases such as diabetes and cardiovascular diseases, which further elevates the need for medical care. Hospitals in major cities will also often attract patients from extensive catchment areas, sometimes spanning four to five hours away, supporting the rationale to scale.

Historically, the healthcare landscape in India was dominated by small, family-run nursing homes operated by one or two doctors. As these practitioners age, many are looking to sell or close their businesses, presenting a prime opportunity for organized hospital groups to acquire and expand their portfolios. Furthermore, these “mom and pop” establishments typically suffer from inefficient management, while organized healthcare groups would leverage standardized processes and practices to enhance operational efficiency and quality of care. Fortis, for example, has recently acquired a 200-bed hospital in Northern India, where management estimates that margins can be improved from the current 10% to nearly 24%.10

This consolidation not only enhances operational efficiencies and profitability but also signifies the vast potential for scaling India’s healthcare infrastructure. By addressing unmet needs and optimizing management practices, organized hospital chains are well-positioned to capitalize on the growing demand and drive significant growth within the sector.

For sophisticated investors only. For informational purposes only. The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

This material is prepared by Shikhara Investment Management LP (“Shikhara”). This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

The Fund managed by Shikhara may or may not hold all of, or some of the securities mentioned in the article.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.