As global trade dynamics shift and geopolitical tensions persist, India’s economic narrative also continues to evolve. In our April report, we examine how India is positioning itself amid US-China trade tensions, particularly in manufacturing, while maintaining domestic growth momentum. Despite near-term challenges, including recent Indo-Pak tensions, India’s strengthening position in global markets and manufacturing presents compelling opportunities for long-term investors. For us, these times remind us that in an industry where active management faces increasing pressure, survival requires vigilance and adaptability. Enjoy!

Indian equities extended their rally in April, gaining 4.82% (in USD terms1). Equity inflows from institutions stood at USD 3.4 billion, supported by domestic mutual funds (+USD 4.2 billion) and foreign professional investors (FPIs) (+USD 0.5 billion).2 Aside from IT, all sectors saw positive returns in April, with Energy and Communication Services leading performance.

While manufacturing sentiment declined across Asia, India remained a bright spot with a robust manufacturing purchasing managers’ index (PMI) reading of 58.2 in April (vs 58.1 in March).3 Similarly, services PMI was also strong, improving 0.2pts m/m to 58.7 in April.4 On both sides, expansion was driven by strong new business growth, supported by effective marketing, operational efficiencies, and robust export orders. Firms also quoted benefits from better margins as cost pressures eased, while prices charged rose at a faster pace.

The Reserve Bank of India (RBI) delivered a 25bp rate cut to 6.00% at its first FY26 Monetary Policy Committee (MPC) meeting, while shifting its stance from “neutral” to “accommodative”. The decision was supported by improving inflation dynamics, particularly moderating food prices, though growth concerns persist following the slowdown since 2QFY25. The central bank revised down its FY26 GDP growth forecast to 6.5% from 6.7%, citing increased global uncertainties, particularly the impact of recent US tariff measures.

Consumer price index (CPI) inflation moderated to 3.3% y/y in March (vs 3.6% in February), reaching a 67-month low due to a sharp correction in food inflation. Food & Beverages inflation eased in March thanks to deflation in vegetable prices.

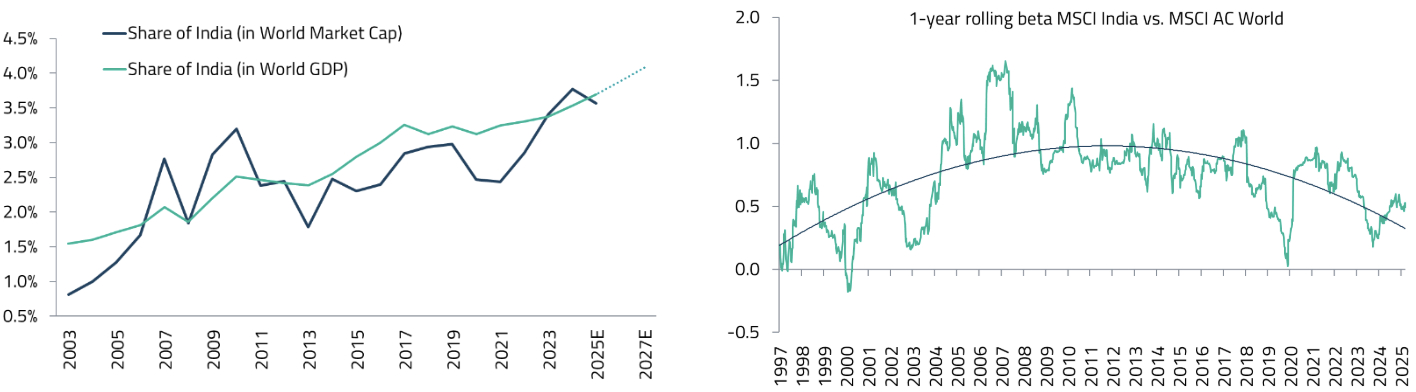

Market chaos is nothing new, as evidenced by multiple crises over the past three decades – from the Asian Financial Crisis in 1997 to the 2008 Global Financial Crisis, and the more recent 2020 COVID crash. Yet historically, periods of uncertainty have consistently unveiled compelling investment opportunities for those prepared to act. For us, the key to navigating uncertainty is controlling the controllables and honing our core investment skills. The focus remains on portfolio quality and risk-reward dynamics. While staying aware of macro factors is crucial, we cannot let them paralyze our investment process or distract us from fundamental analysis.

Against this backdrop, India’s trade negotiations have taken on heightened significance. Among Asian peers, India appears to have gained the most traction in discussions with the Trump administration. However, negotiations remain complex, particularly around non-tariff barriers, with US concerns focused on India’s Quality Control Orders (QCOs). While QCOs serve to enforce compliance with Indian Standards, their stringent requirements could potentially hinder India’s ability to fully capitalize on manufacturing shifts away from China. Ongoing discussions center on potential relaxations of these quality norms for certain sectors. Encouragingly, April’s notable uptick in new export orders suggests early signs of production shifts to India, as global businesses begin adapting their supply chains in response to the evolving trade landscape and US tariff announcements.

Beyond the trade dynamics, domestic economic indicators are showing signs of improvement after bottoming in Q1. India’s large internal market provides a natural buffer against global uncertainties, while also strengthening its negotiating position with the US in the current tariff environment. While AI and technological disruption pose potential challenges to job creation, India’s emergence as a preferred destination for manufacturing amid the China+1 shift presents significant opportunities. This strategic positioning, combined with its substantial domestic market, is likely to attract renewed FDI interest as global companies seek to diversify their manufacturing bases.

However, the influx of new investments, while positive for growth, could intensify competition across sectors. We’ve already seen this, particularly in consumer sectors like paints, groceries, and e-commerce retail. While these sectors initially benefited from the news of consumption stimulus and rate cuts earlier this year, increasing competitive pressures are weighing on earnings expectations, leading to continued downgrades in certain names. However, the broader consumption outlook remains resilient, supported by healthy rural dynamics. Favorable monsoon forecasts for 2025 point to robust agricultural performance and controlled inflation, which should at least help sustain rural demand momentum.

Over the past week, we’ve seen heightened tension between India and Pakistan – a result of India undertaking surgical strikes inside Pakistan to avenge for the terrorist attack in Pahalgam in late April. After a tense week, both parties have agreed to a ceasefire, realizing the grave consequences of a prolonged conflict across a densely populated region. We hope that pragmatism will prevail as both parties focus on medium-term economic growth and development.

In a world of volatility, India offers relative predictability and resilience. Falling oil prices, to which India is highly sensitive as a net importer, help narrow the current account deficit and ease inflationary pressures. Simultaneously, foreign investors, who had been underweight in Indian equities, are increasingly looking at the market as a safe haven with high return potential.

Indian equities have historically traded at a premium to emerging markets, and this premium has expanded further as China faces a structural de-rating. From a mere 8.3% in 2016, India’s weight in the MSCI Emerging Markets Index has grown to 19.4% in 2024, reflecting global recognition of India’s growing importance.5

Consumer companies reported mixed results in Q1 2025, with staples experiencing muted urban demand while rural demand showed gradual recovery. The jewelry sector demonstrated exceptional growth, driven by rising gold prices and robust wedding demand, while quick service restaurant (QSR) players maintained positive same-store sales growth. Premium segments, especially in alcohol/beverages and beauty retail, continued their strong performance trajectory.

In the financial sector, large private banks showed margin expansion and stable asset quality, though public sector undertaking (PSU) banks underperformed. Non-banking financial companies (NBFCs) presented a mixed picture – housing finance companies exceeded expectations, while vehicle financiers struggled with elevated credit costs. The microfinance segment, despite current challenges with high slippages, shows early signs of improvement. Capital market activity displayed initial signs of recovery toward the end of Q4FY25, though demat account additions slowed compared to the previous quarter.

Within manufacturing and infrastructure, companies reported relatively strong Q1 performance. The cables and wires sector stood out, with major players reporting strong y/y earnings growth, driven by channel restocking amid rising raw material prices. While the near-term outlook remains positive, supported by strong domestic demand and power sector growth, manufacturers are adopting a cautious stance on global expansion due to pending US tariff negotiations. The sector faces potential headwinds from increased competition, with new entrants expanding capacity, though companies maintain focus on product innovation to stay competitive.

Following the imposition of steep import tariffs by the US on goods from China and Vietnam, several global mobile phone brands are now considering relocating their manufacturing operations from these countries. India has emerged as a preferred alternative, partly due to its ongoing advanced trade negotiations with the US, which could help mitigate the impact of these tariffs. Notably, three major non-Chinese smartphone companies – Apple, Samsung, and Google – have shown interest in expanding their manufacturing footprint in India, particularly for exports to the US. Apple has already begun scaling up its operations with a concrete plan in place, while Samsung and Google are still in the early stages of discussion.

India offers a large and dynamic domestic market, supported by a maturing Electronics Manufacturing Services (EMS) ecosystem developed over the past decade. The Indian government has actively promoted electronics manufacturing through various initiatives, making significant strides in this sector. From just two mobile manufacturing units in 2014, the country now boasts over 300 such facilities.6 Back in 2014–15, only 26% of mobile phones sold in India were locally produced; today, that number has surged to 99.2%.7 The total manufacturing value of mobile phones in India has grown more than 22-fold over the last ten years, reaching approximately USD 50 billion in FY24.8 Currently, India produces over 325 million mobile phones annually, and exports (which were virtually nonexistent in 2014) have now exceeded USD 15 billion.9

Despite this progress, India’s contribution to the mobile manufacturing value chain is still largely limited to assembly. To enhance value addition, the government recently introduced a Production-Linked Incentive (PLI) scheme for electronic components. This scheme offers incentives based on both revenue and capital expenditure and includes parts like camera modules, display units, bare printed circuit boards (PCBs), and enclosures for IT hardware. For India to truly move up the value chain, technology transfer from foreign firms will be crucial. If implemented effectively and swiftly, this initiative could unlock a multi-billion-dollar opportunity for India while addressing one of its most pressing challenges—unemployment—since mobile manufacturing and assembly are labor-intensive industries.

For sophisticated investors only. For informational purposes only. The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

This material is prepared by Shikhara Investment Management LP (“Shikhara”). This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objectives and risk tolerance levels. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. The information and any opinions contained in this document have been obtained from sources that Shikhara considers reliable, but Shikhara does not represent that such information and opinions are accurate or complete, and thus should not be relied upon as such. Furthermore, all opinions are current only as of the date of distribution and are subject to change without notice. Shikhara does not have any obligation to provide revised opinions in the event of changed circumstances. Whereas Shikhara has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

MSCI India Index is designed to measure the performance of the large and mid-cap segments of the Indian market. The index covers approximately 85% of the Indian equity universe. MSCI Emerging Markets Index captures large and mid-cap representation across 24 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The contents of this material are prepared and maintained by Shikhara and have not been reviewed by the Securities and Exchange Commission of the United States.

The Fund managed by Shikhara may or may not hold all of or some of the securities mentioned in the article.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom, and the European Union and pending registration in the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.