We often say that macroeconomic factors typically represent background noise in our bottom-up investment process – until they don’t. We believe we’ve reached such an inflection point. A fundamental global realignment is underway, catalyzed by recent trade actions but reflecting deeper structural shifts. In this quarter’s report, we look beyond immediate market reactions to decipher policymakers’ intentions and to map potential outcomes across various scenarios. While diplomatic maturity would eventually prevail among global leaders, leading to better news flow in the coming weeks, we stand ready to reassess our positioning should that be otherwise. For now, we see this period of uncertainty creating compelling opportunities for long-term investors. We hope you find this quarter’s insights helpful in navigating these dynamic times.

The MSCI All Country Asia Ex-Japan Index was up 1.89% (in USD terms1) over Q1 2025, with a flattish rise of 0.06% in March. Relative to the rest of the region, China and Singapore were the outperformers for the quarter, while Thailand and Taiwan were the laggards. Sector-wise, Communication Services and Consumer Discretionary led performance over Q1, while IT and Utilities were the worst performers.

MSCI China was up a modest 1.99% in March, bringing total Q1 returns to 14.98%. Despite US tariff concerns, returns were supported by improving economic data and policy signals, while excitement around Chinese firms’ advancements in AI and high-tech industries sparked a re-rating in internet and growth stocks. China’s manufacturing sector saw steady improvements throughout the quarter, with the official manufacturing Purchasing Managers’ Index (PMI) reaching a 12-month high of 50.5 in March, driven by a mix of improved domestic demand and foreign frontloading.2

Indian equities surged in March, with the MSCI India Index up 9.40% after five consecutive months of decline. This reduced the contraction seen YTD, bringing Q1 returns to -2.90%. The March rally was fueled by a turnaround in foreign investor inflows, with foreign institutional investors (FIIs) recording net inflows of USD 0.2 billion in March. However, FII outflows from Indian equities for the calendar year YTD stand at USD 13.5 billion (vs USD 0.8 billion the same time last year).3 Meanwhile, India’s inflation showed signs of cooling and industrial output improved, bolstering overall sentiment.

Korean equities fell 0.84% in March, though Q1 returns were up 5.18% overall. The market initially saw a rebound in January before renewed US tariffs led to a hit on Korean exporters. On the bright side, domestic inflation has come in near the 2% level, allowing the Bank of Korea (BoK) to lower its base rate by 25 bps to 2.75% at the February 2025 meeting. However, overall investor sentiment remained subdued amid the uncertain global trade backdrop and a lukewarm outlook for the semiconductor cycle.

Taiwan was the worst-performing market in March, with equities falling 11.49% for the month and down 12.56% over Q1 2025. The island’s tech-heavy market was roiled by foreign selling as investors trimmed their positions on concerns over the impact of US tariffs and the potential slowdown in global chip demand. The concerns were reflected in Taiwanese manufacturers, where PMI fell 1.7pts to 49.8 in March, marking the first contraction in a year.

Within ASEAN, Indonesian equities rebounded strongly in March (up 6.78% m/m), but Singapore led performance for Q1 2025 (up 10.15% q/q). Investors favored Singapore as a relative safe haven amid volatility, while the Monetary Authority of Singapore’s (MAS) latest measures to reform and strengthen its local stock market have resonated well with investors. On the downside, Thailand was the worst-performing market in the region both in March (down 2.19%) and Q1 2025 (down 13.56%) as growth signals, such as tourist arrivals, continue to soften. In response, the Bank of Thailand delivered a 25bp rate cut in late February, marking its lowest level since July 2023.

The recent trade actions by the US administration, while shocking markets, could mark the beginning of a necessary global economic rebalancing. While immediate market reactions reflect uncertainty, we see a more nuanced picture emerging – one that potentially leads to a vastly different, but perhaps more sustainable global economic order.

To understand the current situation, we must acknowledge that over the past two decades, the global investment landscape has been significantly shaped by China’s remarkable integration into the world economy. Since joining the World Trade Organization (WTO) in 2001, China embarked on an aggressive investment trajectory, particularly post the 2008 global financial crisis (GFC), leading to substantial overinvestment relative to the rest of the world.

This period saw China become a manufacturing powerhouse, supported by extensive infrastructure projects and export-oriented policies. But while China built vast industrial complexes, sometimes even resulting in excess capacity, Western nations experienced a systematic dismantling of their industrial base. This wasn’t simply about losing factories; it meant the erosion of entire industrial ecosystems, including supplier networks, technical expertise, and manufacturing know-how, which has become all the more evident with the latest developments in high-tech sectors like AI, robotics, and automation.

Correcting these distortions requires a complex and likely painful rebalancing process. China needs to shift its focus toward domestic consumption, while Western economies must rebuild their industrial bases and redirect capital toward productive investment. While the process may create near-term economic headwinds, one could argue that it’s essential for establishing a more sustainable and resilient global economic order. And tariffs were perhaps just the necessary catalyst.

From a US perspective, the current administration has set out to achieve two things: 1) to reindustrialize the US and rebalance bilateral trade flows, and 2) to reduce the fiscal deficit and create a more efficient government. On the former, while the latest implementation of tariffs may seem aggressive, the underlying message is clear – countries willing to invest in US manufacturing capacity may find themselves subject to more favorable trade terms. This carrot-and-stick approach, while disruptive in the short term, could catalyze a much-needed rebalancing of global trade and investment flows. By imposing tariffs, the US is taking proactive steps to mitigate its unsustainable trade deficit and reduce dependency on cheap imports.

On the latter objective, the post-GFC era saw significant expansion of government regulation and spending, creating what many view as bureaucratic bloat. The current administration’s focus on deregulation and spending efficiency, while potentially slowing near-term growth, could lead to a leaner, more competitive economy. The good news is that, unlike the 2008 financial crisis, US households aren’t burdened with excessive debt. Thus, the country’s likely economic downturn, driven by a slowdown in consumer spending, should be relatively mild and short-lived.

For corporate America, most large businesses are well-positioned to weather this period of transition, potentially 1-2 quarters of uncertainty. Moreover, there’s a growing recognition among corporate leaders that the era of concentrated supply chains, particularly the heavy reliance on sourcing from China, is ending. This isn’t merely a reaction to current policies – it reflects a deeper understanding that supply chain diversification and domestic manufacturing capabilities are growing strategic imperatives. This transition will no doubt require significant capital expenditure and investment.

While current global tensions may suggest a deteriorating trajectory, there’s reason for measured optimism – provided key global leaders maintain diplomatic maturity. Recent examples offer encouraging precedents, such as the evolving dynamics between the US and Ukraine. We saw the tense exchange between Presidents Trump and Zelensky at the Oval Office, but subsequent to that, more constructive dialogue has prevailed between the two leaders as they opt for pragmatic cooperation. Even China’s swift retaliation with 36% tariffs, while seemingly aggressive, represents a clear response that sets the stage for eventual negotiation. Assuming rational actors prevail in key leadership positions, we are likely experiencing the most turbulent phase now, and news flow should become more positive once the initial dust settles.

Beyond the near term, the next 2-3 years will mark a critical transition period as the US undergoes its economic “detox”, catalyzing structural changes across other major economies as well. China faces perhaps its most significant transformation, needing to pivot from its investment-heavy model toward more domestic consumption-led growth. As Martin Wolf astutely observed in a recent Financial Times article, China’s fundamental demand weakness persists, while the investment required to generate additional GDP has risen dramatically.4 Historically, China bridged this demand gap through massive current account surpluses, followed by a surge in real estate and infrastructure investment. However, doubling down on manufacturing investment now would only exacerbate overcapacity and inevitably trigger more protective measures against Chinese exports. The solution, therefore, requires a significant boost in domestic consumption to create a more balanced economic model going forward.

This global realignment extends to Europe, which could very well adopt similar protective measures as the US. The prospect of redirected Chinese exports to European markets creates immediate pressure, but there’s a deeper recognition at play: Europe must reinvigorate its domestic investment, particularly in strategic sectors like defense and manufacturing. This marks a fundamental shift from post-Cold War assumptions about European security and economic integration.

What we’re witnessing is the transformation from a globalized economic order to one increasingly defined by nation states. Within this context, here is how we expect the global realignment to unfold across key economies:

These shifts reflect in the growing trend toward reindustrialization, state capacity rebuilding, and strategic autonomy. As the era of unfettered globalization ends, we expect to see countries and regions push to develop greater resilience and self-sufficiency while maintaining strategic partnerships in select areas.

In the current inflationary environment, equities present a compelling investment option. Stocks inherently possess the ability to outpace inflation, as companies can adjust pricing and expand revenues in response to rising costs, providing a natural inflation hedge.

Emerging markets (EMs), especially Asia, are particularly well-positioned, having already undergone significant economic adjustments post-COVID, with inflation remaining relatively contained and within central bank targets. Meanwhile, the US will likely undergo a period of economic “detox” and slowdown in the coming years. As we reflected in our commentary last month, the structural changes, while challenging, are necessary to address the mounting fiscal pressures faced by the US economy.

The latest round of tariffs has no doubt increased the odds of a recession, but what matters is the length of a recession (if any), which we expect will be shallow. Recession odds may also significantly reduce in the coming weeks as the US administration commits to bilateral trade agreements. The YTD fall in the US Dollar Index (DXY) will certainly help in this regard as a weaker dollar can enhance the competitiveness of US exports and temper discussions around trade agreements.

Countries with large domestic consumer markets are better positioned to withstand trade tensions. In this environment, India stands out. Unlike Vietnam and Indonesia, for example, which are primarily export platforms vulnerable to tariffs, India’s massive consumer base offers a good buffer. As Indian exports to the US increase, it can reciprocate by absorbing more American goods and services. This two-way trade potential makes India a more attractive and resilient long-term partner for the US.

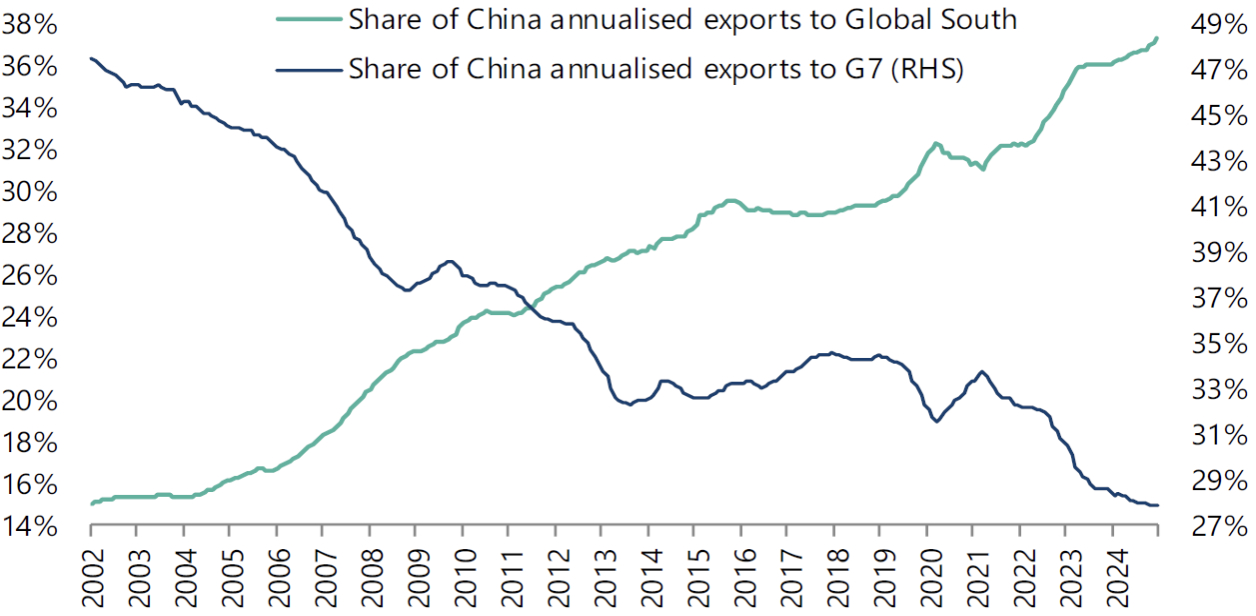

While market attention remains fixated on US-China trade tensions, a profound shift in global trade patterns has gone largely unnoticed. China’s pivot to the Global South represents perhaps the most significant realignment of trade flows in recent decades. Chinese exports to the region have surged from US$772 billion in mid-2020 to US$1.34 trillion by end-2024, now comprising 48% of China’s total exports, up markedly from 21% in 2008.5 Simultaneously, the G7’s share of Chinese exports has declined from 39% to 28%.6 This transformation challenges the conventional wisdom of US market primacy and investors focused solely on US-China dynamics risk missing this fundamental restructuring of global commerce.

Finally, more than tariffs and trade wars, we believe that the impact of artificial intelligence (AI) represents a far more significant disruption that remains underappreciated by most governments and companies. The AI threat will become more apparent when its effects begin cascading through labor markets and existing business models. In India, for example, AI disruption in professional services sectors means that the country needs to ensure its demographic dividend doesn’t become a liability.

We expect this disruption to present compelling buying opportunities, as markets digest the initial shock of trade tensions. While this period of uncertainty may trigger a temporary de-rating across portions of our portfolio, particularly in consumer-facing sectors, we view this as a chance to build positions at attractive valuations.

Our focus remains on companies with specific competitive advantages: digital-native businesses actively investing in AI capabilities, market leaders with strong balance sheets who will be the “last man standing”, and those with robust consumer relationships and clear value propositions. While some companies may face near-term demand headwinds, their strong fundamentals position them to gain market share and emerge stronger through the cycle. In China, the shift in focus towards consumption will be a positive for our portfolio in the coming quarters.

From a defensive standpoint, we have increased our healthcare exposure (now nearly 10% of the portfolio) and large-cap Indian banks, given those sectors’ resilient local demand and limited trade sensitivities. We are also strategically positioned in Indian IT services companies, which offer exposure to US growth while remaining relatively resilient as spending on digitization and productivity-enhancing initiatives takes priority.

We continue to focus on companies with US-based manufacturing operations that are better insulated from trade tensions. A prime example is HD Hyundai Electric, which remains exempt from the recently announced anti-dumping duties on Korean high-voltage transformers due to its US manufacturing presence. This contrasts with competitors facing duties of up to 18%. The transformer sector highlights our broader investment thesis: despite trade barriers, demand for critical infrastructure components continues to grow, driven by AI data center expansion and aging US grid infrastructure. We are particularly focused on companies producing essential, hard-to-replace products that the US market fundamentally requires, especially those with domestic manufacturing capabilities, as they are better positioned to navigate the evolving trade landscape.

Each quarter, we highlight a select number of companies that showcase exceptional growth potential. These stocks on our conviction list represent opportunities we believe will deliver substantial value over the coming years. Here are the standout stocks we’re featuring this quarter.

Prudential is a leading life and asset management group headquartered in the UK. Following strategic demergers of its UK and US businesses, Prudential has emerged as a pure-play Asian insurance powerhouse with an expanding presence in Africa. As the drag from COVID-related disruptions begins to fade, strong new business sales growth and a higher-for-longer US bond yield environment are expected to provide tailwinds for profit growth.

The Asia-based management team is new, and confidence in management is likely to improve as it continues to execute its strategic plan. The management has articulated a clear strategy with well-defined targets. What makes Prudential’s story compelling is its robust growth trajectory and improving fundamentals. New business profit grew by 11% in 2024, and management is guiding for 10% growth across all key metrics in 2025.7 The company’s ambitious target of US$4.4 billion in operating free surplus generation by 2027, up from US$2.6 billion in 2024, demonstrates its strong capital generation potential.8 Additionally, Prudential’s execution in mainland China is noteworthy. Despite market challenges, the company has completed its restructuring and expects continued high single-digit growth.

With over 25% of its market capitalization expected to be returned to shareholders through dividends and potential special buybacks, and trading at attractive valuations relative to European and local peers, Prudential offers investors exposure to Asia’s structural growth story through a company with proven capital discipline and multiple growth drivers.

ICICI Bank is India’s second-largest private sector bank by assets, with a dominant digital banking franchise and comprehensive retail and wholesale banking offerings. Through its strategic focus on technology and innovation, ICICI has emerged as a leader in India’s digital banking transformation, with digital channels now contributing 26% of retail revenues and 30% of retail profit before tax.9

What we like about ICICI Bank is its outperformance in both growth and efficiency metrics. The bank has maintained robust loan growth of 17-20% y/y while expanding deposits at an impressive 16.35% CAGR between FY20 to FY24.10 Its strategic pivot toward higher-margin retail and SME segments, now comprising 78% of the loan book (up from 67% pre-pandemic), has helped maintain industry-leading net interest margins (NIMs) of 4.3-4.5%.11 Meanwhile, disciplined cost management has driven consistent improvement in cost-to-income ratios.

With a loan-to-deposit ratio of 86-87% reflecting prudent balance sheet management, strong asset quality metrics, and return on assets of 2.1-2.2%, we think ICICI Bank offers exposure to India’s banking sector growth through a well-managed franchise.12

As India’s dominant online travel agency (OTA) with ~5x the gross booking of its nearest competitor, MakeMyTrip is uniquely positioned to capture the country’s expanding travel market.13 India’s online travel industry’s total addressable market (TAM) is projected to reach US$60 billion by 2030, up from US$12 billion in 2022, driven by the country’s robust GDP growth, rising internet penetration, and expanding middle class.14

MakeMyTrip’s competitive moat continues to widen through network effects: more suppliers provide better pricing and inventory, attracting more customers, which in turn draws more suppliers. This virtuous cycle has helped the company capture 65% of monthly active users in the space while maintaining healthy take rates of 17% on hotel bookings, in line with global peers.15

While near-term take rates may face some pressure, particularly in air ticketing, the company’s scale and market position should help maintain profitability. Moreover, operating leverage is expected to improve as customer acquisition costs stabilize. With a clean balance sheet and growing free cash flow yield, MakeMyTrip offers exposure to India’s structural travel growth story through a proven market leader with expanding margins.

For sophisticated investors only. For informational purposes only. The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

This material is prepared by Shikhara Investment Management LP (“Shikhara”). This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Private Placement Memorandum for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

The fund managed by Shikhara holds the securities mentioned under “Quarterly Conviction Calls” section in the article.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.