2025 has started on an eventful note; with Donald Trump and the AI arms race, there has been no dearth of action. The key for us as investors is to prepare to navigate this uncertainty with deep insights, an experienced team, and a strong process. In this month’s report, we analyze the moderating forces in US-China trade tensions, explore DeepSeek’s transformative impact on AI democratization, and assess India’s recently announced FY26 budget. We hope you find valuable insight in this report, and may the year of the snake’s attributes of wisdom and adaptability serve us well as we navigate these dynamic markets together.

The MSCI All Country Asia Ex-Japan Index ended up 0.76% (in USD terms1) for the first month of the year, despite a pullback in the first half on weak sentiment in the leadup to President Trump’s inauguration. Relative to the rest of the region, South Korea and Singapore were the top performers, while the Philippines and Malaysia were the worst performers. Sector-wise, IT and Consumer Discretionary led performance, while Utilities and Real Estate were the laggards.

MSCI China rose 0.96% in January, rebounding strongly in the latter half of the month. Market sentiment improved following signals of constructive dialogue between Presidents Trump and Xi, easing concerns over worst-case tariff scenarios. DeepSeek’s launch of its advanced AI reasoning model also helped reignite investor interest in China’s tech sector. Meanwhile, Chinese regulators have set specific domestic equity allocation targets for mutual funds and state-owned insurers, signaling policy support for the market. China’s goods trade surplus reached a record high of USD 992 billion in 2024, with December alone accounting for USD 105 billion as manufacturers front-loaded orders in anticipation of potential tariffs.2 China saw Q4 GDP grow 5.4% y/y, exceeding market expectations, bringing full-year growth to 5.0% for 2024.

MSCI India declined 3.53% in January, lagging regional peers amid mixed corporate earnings and a cautionary pre-budget sentiment. The Union Budget, presented on February 1, prioritized fiscal consolidation while maintaining a growth focus. Though capital expenditure targets were modest, the budget supports consumption through income tax relief while maintaining the status quo on capital gains and corporate taxes. Key macroeconomic indicators during the month remained robust: central government capex surged to INR 1.7 trillion in December (up 95.3% y/y), versus a monthly average of INR 640 billion from April to November 2024.3 GST collections reached INR 1.96 trillion in January, their second-highest level, growing 12.3% y/y (vs 7.3% y/y in December).4 Manufacturing PMI hit a six-month high of 57.7 in January, driven by strong export orders, while services PMI, though moderating to 56.5 (vs 59.3 in December), remained firmly in expansion territory.5

Leaving behind its deep correction in 2024, Korean equities emerged as the top performer among regional peers in January, gaining 6.29% during the month. Markets showed resilience, shrugging off December’s political turbulence surrounding President Yoon’s martial law controversy, as investor sentiment strengthened following Trump’s inauguration rhetoric and soundbites, which were seen as favorable to Korean defense, semiconductor, and shipbuilding sectors. While foreign investors maintained their selling streak for the sixth consecutive month, offloading USD 647 million worth of KOSPI-listed stocks (primarily in tech names affected by DeepSeek’s developments and potential US tariff concerns), strong domestic buying provided market support.

Taiwanese equities rose 3.32% in January, weathering pre-Chinese New Year (CNY) selling pressure from foreign institutional investors (FINIs) and local proprietary traders. Market sentiment was bolstered by developments at the 2025 Consumer Electronics Show (CES) and the announcement of the Stargate project, while the market closure for CNY holidays helped insulate Taiwan from the immediate DeepSeek-related volatility. Taiwan’s Q4 GDP growth decelerated sharply to 1.8% y/y (vs 4.2% y/y in Q3), driven by weaker-than-expected net exports. However, the economy achieved a three-year high with full-year GDP growth of 4.3% in 2024, supported primarily by robust domestic demand.

Within ASEAN, Singapore was the only market to post positive returns in January, gaining 4.59%. Investors favored Singapore, particularly banking stocks, as a relative safe haven amid volatility, while anticipated stock market reforms also remain on investor minds. The broader ASEAN region declined as markets priced in delayed US Federal Reserve interest rate cuts. The Philippines and Malaysia were the weakest performers in January, falling 9.77% and 4.71% respectively. Malaysian equities faced foreign selling pressure, particularly in AI and data center proxy stocks, following tighter US semiconductor export restrictions and market reaction to DeepSeek’s R-1 model release. Overall, the region saw robust economic expansion for the year just passed, with Singapore delivering 4.0%, Malaysia 5.1%, and Indonesia 5.0% GDP growth in 2024.

Financial markets serve as a crucial feedback mechanism for policymakers, effectively constraining extreme policy decisions by creating negative market reactions that force course corrections. We saw this in China, where falling markets prompted government stimulus, and in India, where recent market pullbacks encouraged some relief in income tax and no increases to corporate tax or Capital Gains Tax (CGT).

The same market-driven moderation will likely play out in current US-China tensions. Unlike Trump’s first term, today’s inflationary environment makes aggressive trade measures a politically risky move. Substantial tariffs would strengthen the dollar and undermine the US’s reshoring ambitions. Thus, as we’ve postulated since October, the use of aggressive tariffs is unlikely to materialize.

Recent signals support this view: the 10% tariff on China announced on February 1 was a lot milder than markets expected, especially compared to the 25% on neighboring countries Mexico and Canada. China’s response was also very tame, with Beijing announcing additional tariffs of 10-15% on US goods, including coal, LNG, crude oil, agricultural machinery, and large autos while tightening export controls on some rare earth materials. It’s clear that both parties are keeping room for negotiation, and soundbites are indicating both sides are maintaining dialogue, which we expect will move towards a deal.

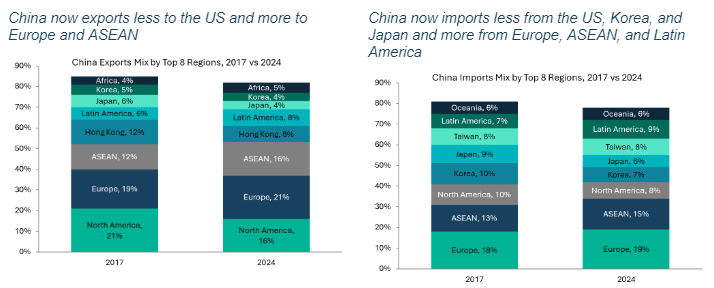

The economic reality is that the US is more dependent on Chinese imports than China is on US imports. In 2024, the US imported ~USD 525 billion of Chinese goods, representing 14% of total US imports.6 In contrast, China imported ~USD 164 billion of goods from the US, accounting for 6% of its imports.7 Since the first trade war, China has successfully diversified its export markets toward ASEAN, EU, Latin America, and Africa while reducing import dependency on North America, Japan, and South Korea.

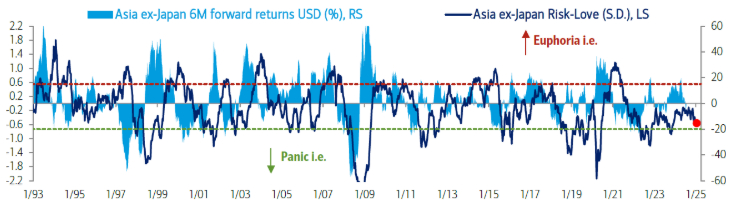

Additionally, unlike the start of the first trade war, when China faced severe earnings downgrades, current sentiment is already bearish while the earnings recovery cycle remains intact. Chinese valuations are compelling, setting the stage for potential upside as analyst and investor sentiment improves with signs of de-escalation.

DeepSeek’s latest AI reasoning model, R1, is pushing the boundaries of possibility as AI continues to advance rapidly. While US tech names saw an immediate correction, we remain more optimistic than ever about the AI revolution. We draw parallels to the 2000s when massive fiber optic networks were built – infrastructure that later became the backbone of unprecedented productivity gains. Similarly, DeepSeek’s lower-cost approach now moves us closer to democratizing computing power and capabilities. Already, major cloud providers, including Amazon, Alibaba, and Microsoft, have integrated DeepSeek’s AI models into their platforms, allowing users to seamlessly train, deploy, and run inferences with no coding expertise required.

As AI infrastructure and hardware become more commoditized, the focus will shift to companies that can effectively deploy AI to enhance their business. The winners of this era will be industry leaders who can combine the following three criteria:

With the above characteristics, the integration of Large Language Models (LLMs) into a business’s ecosystem can unlock two opportunities to form a wider moat: 1) deeper consumer loyalty and 2) dynamic cross-selling and upselling. LLMs will far surpass the rigid, rules-based approaches of legacy systems through their ability to understand context, adapt in real-time, and generate personalized interactions.

~32% of the portfolio is exposed to leading platform companies and digital natives who are at the forefront of these AI initiatives. Some of these firms already capture over 50% of their sector’s market share and are poised for greater expansion as their AI capabilities advance. Examples include e-commerce giants who are deploying LLMs to optimize their supply chain forecasting by predicting regional demand spikes. We also see food delivery platforms using AI to analyze user behavior to predict cravings and provide hyper-personalized recommendations.

The applications of AI across these platforms are almost limitless, with each new use case unlocking further opportunities for value creation and competitive differentiation. Enabling such opportunities are the enterprise AI solutions providers. Indian IT services companies like Cognizant and Infosys are well-positioned as essential partners in this AI transformation, helping organizations modernize legacy information, data, and processes.

Beyond the future applications of AI, DeepSeek’s breakthrough underscores a broader narrative about Asia’s technological capabilities that markets have largely overlooked. With China alone now producing more STEM graduates annually than the rest of the world combined, the region possesses an unparalleled technical talent pool.8 This human capital advantage, coupled with a deep engineering skillset, positions Asian tech companies for significant innovation and growth while trading at a fraction of their US peers.

The government’s FY2026 budget strikes a careful balance between fiscal consolidation and growth stimulus. The framework demonstrates continued commitment to fiscal prudence while introducing targeted measures to boost middle-class consumption. Some key takeaways from the announcement:

While this announcement signals potential tailwinds for Indian discretionary consumption stocks, we maintain a selective approach given the competitive intensity that remains across segments. In categories like quick-service restaurants and quick commerce, market leaders are pursuing aggressive expansion plans, and we continue to watch the potential impact on margins. Companies that can execute efficiently while building strong brand loyalty will emerge as the winners in this high-stakes battle for consumer mindshare.

From a market perspective, the pullback, which now runs into its 5th month, is showing signs of bottoming. The current decline matches typical patterns we’ve seen over the past decade, where investor sentiment is reaching near-panic levels, preceding a market rebound. Market valuations have returned to reasonable levels after the recent correction, creating attractive entry points. With key events like the budget now announced, we expect markets to rebound in the near future.

High real rates appear to be achieving their desired effect in the US, as COVID-era excess savings have now been depleted. Softening hiring data and declining service PMIs indicate a slowdown in the US economy. This, along with moderate tariffs, is likely to be followed by a peak in the US dollar and interest rates. Consequently, we expect investors will increase allocations to Asian markets, which are currently trading at a 30-year discount to their developed market peers.

For sophisticated investors only. For informational purposes only. The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

This material is prepared by Shikhara Investment Management LP (“Shikhara”). This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

The Fund managed by Shikhara may or may not hold all of, or some of the securities mentioned in the article.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.