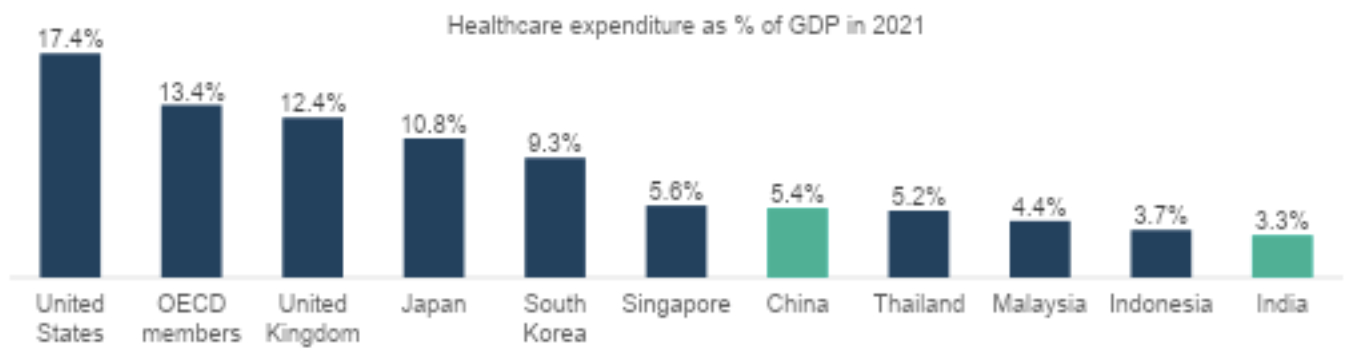

Asia is home to ~59% of the global population,1 yet its healthcare spending as a percentage of GDP remains lower compared to developed regions.2 However, as Asian economies continue to advance, we anticipate that healthcare expenditure will begin to outpace GDP growth across the region.

This shift is primarily driven by significant demographic transformations in Asia, leading to evolving healthcare needs. Key factors include:

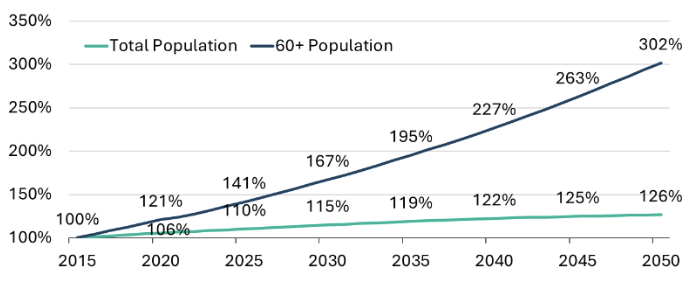

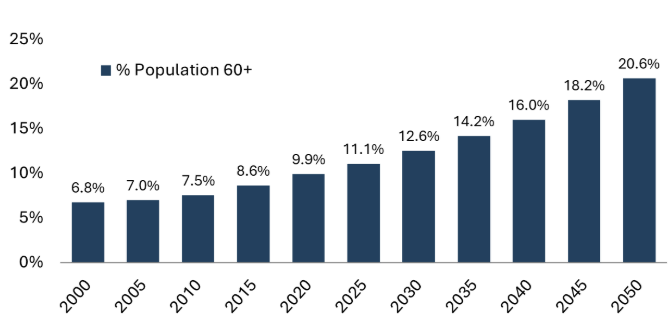

A demographic shift: Asia is experiencing rapid population aging, with countries like China and South Korea leading the trend. By 2050, the region’s elderly population (individuals aged 60+) is projected to reach nearly 1.2 billion.3 Specifically, in China, the number of individuals aged 65+ is expected to climb to 256 million by 2030, representing 18% of the population, up from 180 million or 13% in 2020.4

Evolving healthcare needs: The aging population is driving growth in various sectors, including healthcare services, pharmaceuticals, medical devices, and innovative technologies such as telemedicine and AI-driven diagnostics.

Healthcare options abroad: An increasing number of patients are considering medical tourism for elective procedures and specialized treatments, where hospitals offer high-quality care at more reasonable costs.

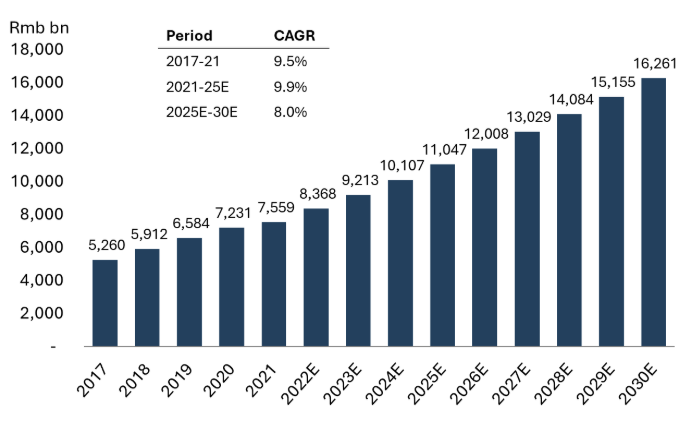

To fully grasp the magnitude of these opportunities, it is essential to examine the two largest economies in the region—China and India.

China’s healthcare environment is characterized by steady demand, driven by unmet medical needs that present significant opportunities for domestic companies to expand and capture market share. Key factors contributing to these unmet needs include a lack of effective treatment drugs—particularly in oncology—delays in early disease detection, and the high cost of imported medications.

From a health perspective, cancer incidence and diabetes prevalence are projected to increase significantly among individuals aged 50-60 and older.5 This rising demand, coupled with improving reimbursement capacities, is fueling domestic innovation within the healthcare sector.

In response to these challenges, Chinese regulatory agencies have implemented strategies to manage the burden of generic drugs through bulk purchasing at the national level, leveraging volume and scale efficiencies. Additionally, they are supporting the reimbursement of innovative drugs by including them in the National Reimbursement Drug List (NRDL). Inclusion in the NRDL boosts drug volumes as doctors and patients benefit from reduced out-of-pocket expenses.

According to Morgan Stanley estimates, the innovative drug market in China is expected to grow robustly at a 13% CAGR from 2021 to 2030, compared to a 3% CAGR projected for the generic drug market.6 This substantial growth is driven by a combination of factors, including domestic substitution, rural market penetration, advancements in precision therapy, and supportive policy initiatives. Together, these elements enhance the visibility and expansion of the innovative drug market in China.

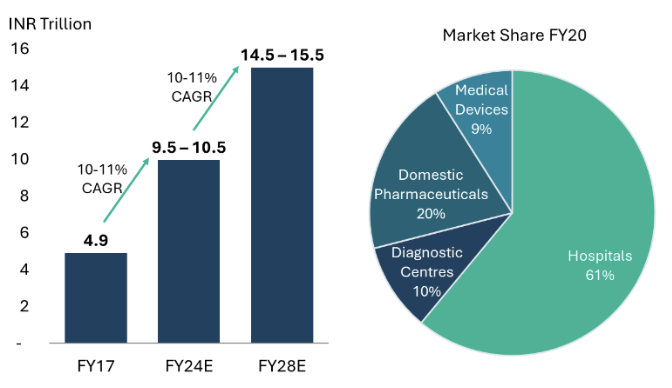

India’s healthcare sector is one of the most rapidly growing sectors globally driven by a combination of economic and demographic factors. According to data and estimates from CRISIL, the healthcare industry in India has grown at approximately 10-11% CAGR over the past decade and stands at ~US$125 billion at the end of FY24.7 In addition to this, India’s pharmaceutical exports, including Finished Dosage Form (FDF) and Active Pharmaceutical Ingredients (API), contribute roughly US$28 billion annually.8 We expect the sector to sustain its growth momentum, maintaining a similar CAGR of 10-11% in the foreseeable future.

India’s healthcare sector can be divided into four broad categories, namely: Hospitals, Diagnostics, Pharmaceuticals, and Medical Devices. All these sub-sectors are experiencing growth that aligns with the overall market trajectory, reflecting the sector’s robust expansion.

While the expansion of India’s healthcare sector in recent decades has been driven by enhanced access to primary and secondary care and greater insurance penetration, future growth is expected to be largely propelled by the rapidly increasing senior citizen demographic. Although India is often recognized as a young country, with 60-65% of its population in the working age group, the elderly population is growing at a much faster pace.9 Projections suggest that the proportion of seniors in the total population could nearly double in the next two decades.10

Given this, we believe India’s healthcare landscape is set for long-term growth. Alongside the increase in insurance penetration and lifestyle-related chronic diseases, the demographic shift toward an aging population, coupled with rising life expectancy and income levels, will ensure that India’s healthcare sector continues to expand at a robust rate.

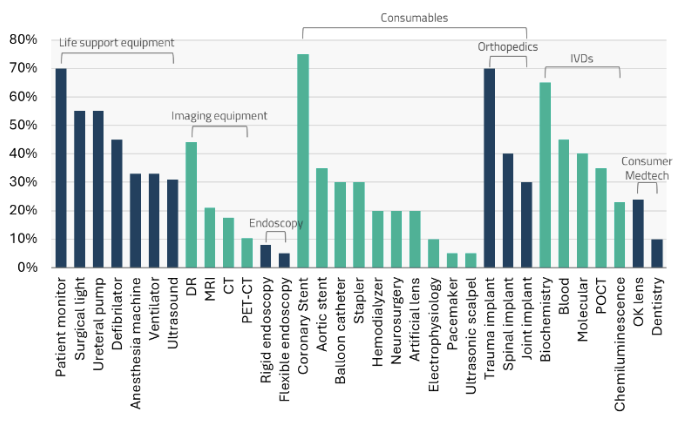

China’s medical devices and equipment market is poised for substantial growth, underpinned by the country’s robust manufacturing capabilities. In 2020, the market was valued at approximately US$54 billion (RMB 351 billion) and is projected to expand to a Total Addressable Market (TAM) of US$129 billion (RMB 838 billion) by 2030, reflecting a 9% CAGR.11 This growth is expected to be primarily driven by the in vitro diagnostics (IVD) and treatment equipment and specialty segments.

Over the past two decades, domestic medical device companies in China have successfully penetrated the lower-tier hospital markets, leveraging competitive pricing and improving healthcare infrastructure. Despite this significant domestic advancement, multinational corporations (MNCs) continue to dominate the high-end segments of the market.

Key areas where MNCs maintain a strong presence include chemiluminescence immunoassays (CLIA), endoscopes, and magnetic resonance imaging (MRI) machines, where advanced technology and substantial research and development investments give them a competitive edge.

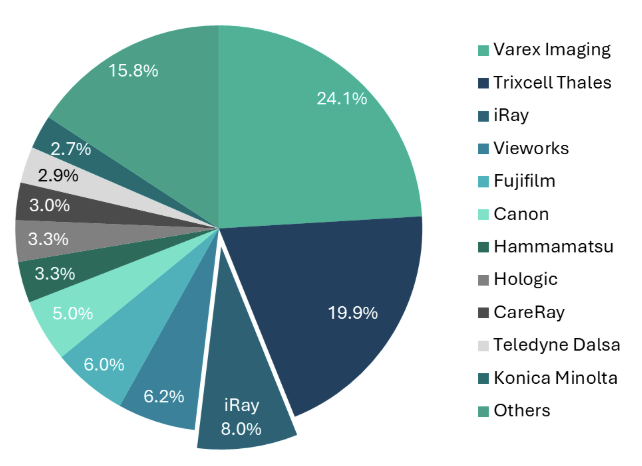

A notable example of China’s manufacturing strength is iRay Technology. As the third-largest flat-panel detector (FPD) manufacturer globally, iRay holds the largest market share in China by volume.12 The company primarily focuses on medical X-ray imaging and accounted for 8% of the global medical FPD market in terms of sales in 2018.13 This highlights China’s ability to compete effectively on the global stage, particularly in specialized areas of medical imaging.

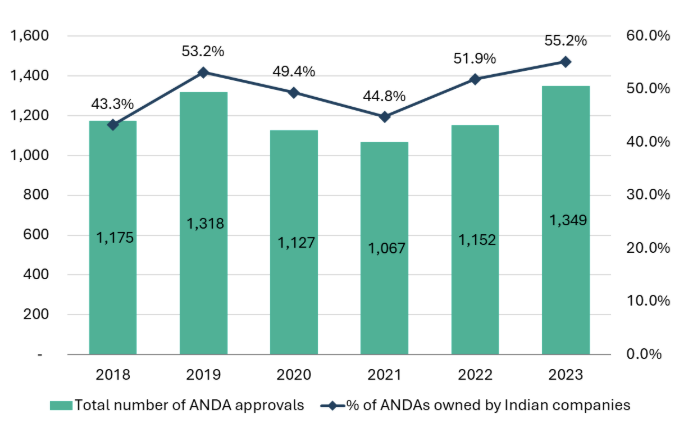

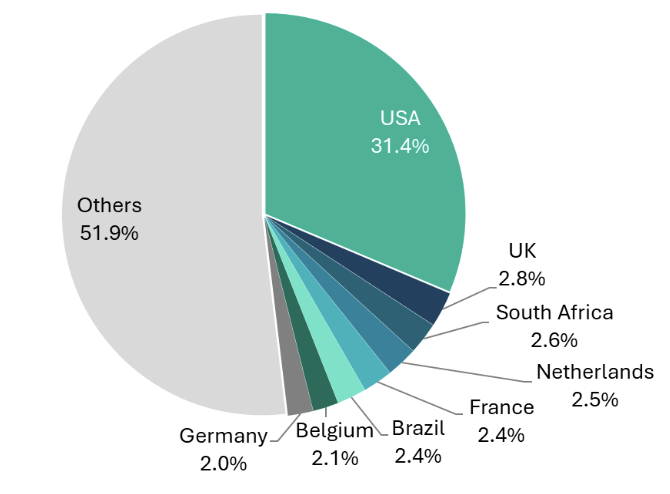

Indian companies dominate the US generics market, and they have the highest number of market authorizations granted by the US Food and Drug Administration (US FDA). Seven of the top 10 companies with the most Abbreviated New Drug Application (ANDA) approvals from 2018 to 2023 are based in India.14

But it’s not just the number of ANDA approvals; Indian companies are recognized for successfully targeting low-competition products as well. In 2023, Indian firms secured 33.2% of Specialty Pharma approvals and 40.5% of Cell and Gene Therapy approvals with exclusivity.15

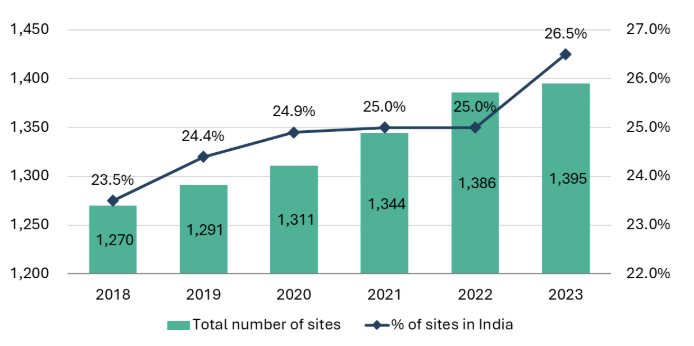

India also leads globally with the most FDA-approved plants, holding 26% of the total share in 2023 with 369 facilities, up from 23% in 2018.16 From 2018 to 2023, US imports of formulations and APIs from India increased from $9bn to $15bn, reflecting a 10.5% CAGR (14.4% in INR terms).17

India’s hospital sector, with a market size of ~US$75-80 billion, is a rapidly growing and integral part of the country’s healthcare system. India has both government-run hospitals that serve large populations, especially in rural and underserved areas, and private hospitals that are often known for offering advanced medical treatments and better patient care.

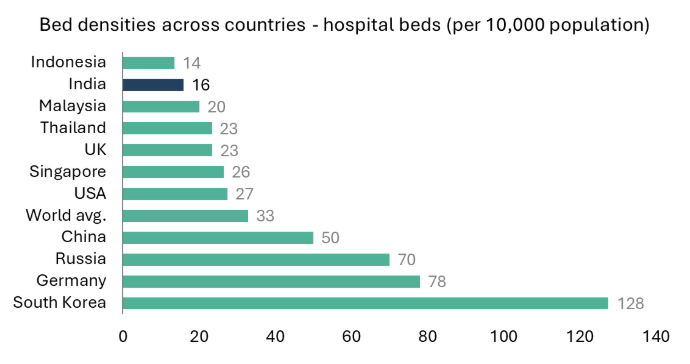

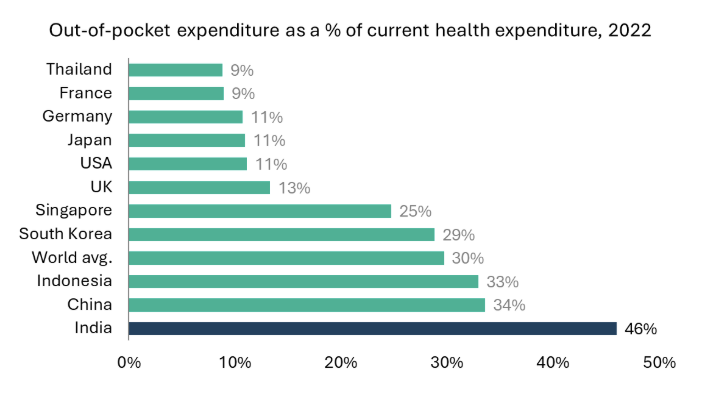

India has seen a consistent improvement in its healthcare infrastructure over the past decades but remains an underserved market. The hospital bed density in India remains to be one of the lowest in the world. While public healthcare spending has increased yearly, it falls short of global standards, leaving the system predominantly privately funded through rising disposable incomes.

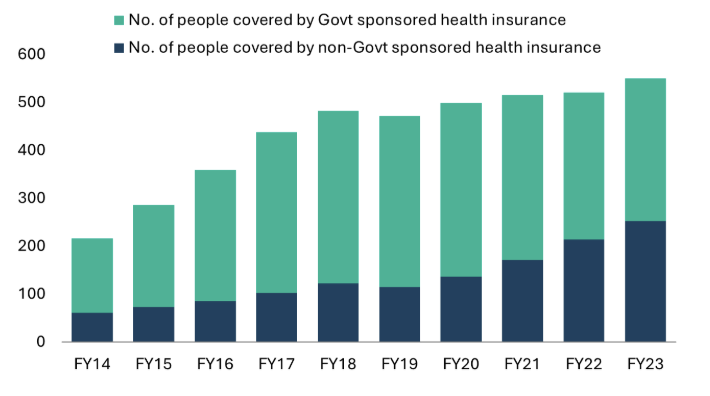

Factors such as increasing population, rising incomes, improvement in medical infrastructure, urbanization, and evolving healthcare needs are driving growth for India’s hospitals. Another key driver is insurance penetration. India has seen a consistent rise in health insurance penetration over the past decades. Government data indicates that ~70% of India’s population currently has some form of coverage or ‘eligibility for coverage’ under the current setup.18

Insured individuals are more likely to seek higher-quality healthcare services that may have been unaffordable in the past. This increase in insurance coverage has primarily benefited branded hospitals and diagnostic centers, resulting in higher patient volumes for these providers.

Among the key players driving the expansion and modernization of India’s hospital sector are Apollo Hospitals and IHH Healthcare.

Apollo Hospitals, one of the largest hospital networks in India, boasts a pan-India presence with a network of 73 hospitals and a bed capacity of over 10,000.19 Apollo has strategically integrated its offline pharmacies and online app to build India’s largest omni-channel healthcare platform. This comprehensive approach not only enhances patient accessibility and convenience but also streamlines healthcare delivery across various touchpoints. IHH Healthcare, a global healthcare provider, operates an extensive network of 80 hospitals across various markets, including Singapore, Malaysia, Turkey, India, and China, managing over 12,000 licensed beds.20 In India, IHH focuses on capturing domestic market demand by offering advanced medical treatments and superior patient care. Meanwhile, its hospital networks in Malaysia and Turkey are geared towards attracting medical tourism from neighboring countries by providing high-end complex treatments with better clinical outcomes at cost-effective prices. This dual strategy allows IHH to cater to both local and international patient bases, driving growth and enhancing the global footprint of its operations.

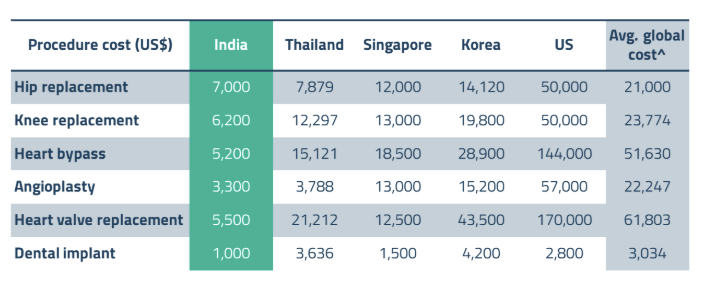

India and ASEAN countries are rapidly establishing themselves as premier destinations for medical tourism, leveraging their modern infrastructure, advanced medical facilities, and highly skilled clinical talent. Leading hospitals in these regions are equipped with state-of-the-art technology and adhere to international standards of care, making them attractive options for patients seeking quality medical treatments abroad.

One of the primary drivers of medical tourism in India and ASEAN is the significant cost advantage these regions offer compared to traditional medical destinations such as the United States and Europe. For instance, procedures like heart bypass surgery in India can cost as little as 10% of the global average, making high-quality healthcare more accessible to a broader range of patients.21 This substantial cost difference is complemented by favorable exchange rates and the availability of comprehensive medical packages that include accommodation, transportation, and post-operative care, enhancing the overall value proposition for medical tourists.

In addition to cost savings, India and ASEAN countries are becoming more recognized for their superior clinical outcomes and specialized medical expertise. Many hospitals in these regions have accreditations from international bodies such as the Joint Commission International (JCI), ensuring adherence to global healthcare standards. Furthermore, the availability of experienced medical professionals and the adoption of cutting-edge medical technologies contribute to high success rates and patient satisfaction. Countries like Thailand, Malaysia, and Singapore within the ASEAN bloc are particularly renowned for their excellence in specialties such as cosmetic surgery, orthopedic procedures, and fertility treatments.

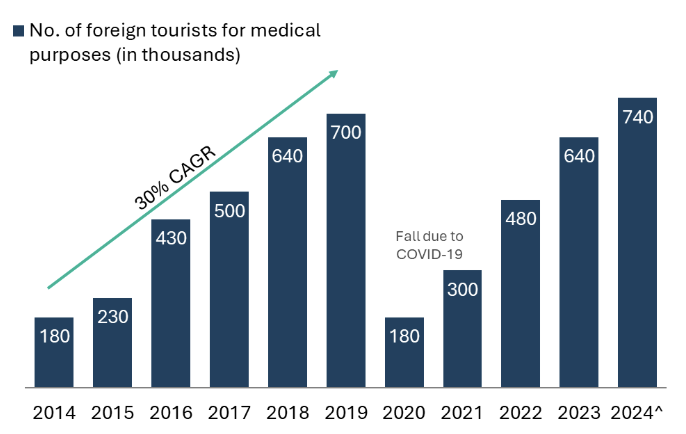

The growth of the medical tourism industry in India is particularly noteworthy. With strategic investments in healthcare infrastructure and government initiatives aimed at promoting medical tourism, India’s foreign medical tourism sector is on a trajectory to attract approximately 3 million medical tourists by 2030.22 This anticipated growth is supported by initiatives like the Medical Visa schemes, streamlined regulations, and the establishment of dedicated medical tourism zones that facilitate seamless patient experiences.

The emergence of GLP-1 (glucagon-like peptide-1) drugs represents one of the most significant pharmaceutical breakthroughs in recent years, offering unprecedented effectiveness in treating both diabetes and obesity. These drugs, which mimic natural hormones that regulate blood sugar and appetite, have demonstrated remarkable results with weight loss in clinical trials.

While Novo Nordisk and Eli Lilly currently dominate the global market with drugs like Wegovy, Ozempic, and Mounjaro, the potential for Asian pharmaceutical companies is substantial as patents begin to expire and regional obesity rates surge. Markets like China and India present compelling opportunities for both domestic drug development and generic manufacturing. Moreover, we think this theme is particularly relevant given Asia’s rising obesity rates, increasing diabetes prevalence, and the region’s growing pharmaceutical manufacturing capabilities.

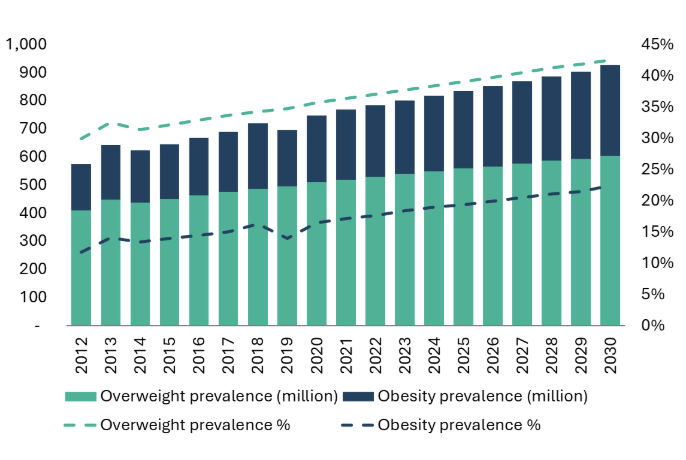

According to cross-sectional studies, by 2019, the prevalence of individuals who are overweight (based on China’s BMI classification of 24-28 kg/m²) was 34.8%, and obese (BMI ≥28 kg/m²) was 14.1%.23 These figures have increased significantly from 22.8% overweight and 7.1% obese in 2002.24 Academic scientists project that by 2030, the domestic prevalence of overweight individuals will rise to 42.6%, and obesity will reach 22.7%.25 Morgan Stanley Research estimates that this could translate to over 600 million overweight and 300 million obese individuals under China’s BMI classifications.26

The growing prevalence of obesity in China presents a substantial market opportunity for GLP-1 drugs, which are effective in managing weight and related metabolic conditions. As the population continues to age and obesity rates increase, demand for effective obesity treatments like GLP-1 analogs is expected to surge, providing significant growth potential for domestic pharmaceutical companies.

Hansoh Pharmaceutical Group, for instance, is strategically positioned to capitalize on this opportunity. The company’s dual-target GIP-1/GLP drug is currently in phase 2 clinical trials, making it one of the initial three players developing such drugs domestically. Furthermore, the company has recently out-licensed its preclinical oral small molecule GLP-1 molecule to Merck for global development, a deal that not only expands its market reach but also validates its R&D expertise.

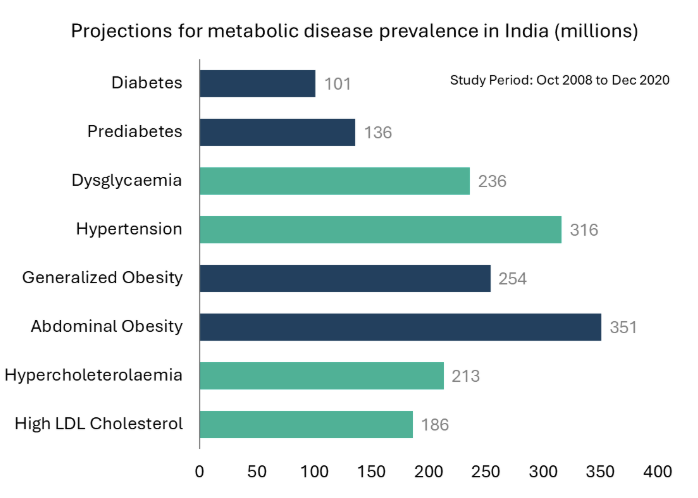

India faces a significant diabetes burden, which is closely linked to obesity. According to the International Diabetes Federation (IDF), India had an estimated 77 million diabetic individuals in 2019, accounting for 14% of the global diabetes population.27 The IDF projects a 61% growth in India’s diabetic population by 2045.28 A study by the Indian Council of Medical Research (ICMR) from 2008 to 2020 estimates India’s diabetic prevalence at 11.4% (101 million) and prediabetic prevalence at 15% (136 million).29 Health organizations rank India’s diabetes burden among the highest globally, comparable to the US and China, despite a lower obese population compared to the US.30

In India, liraglutide, a GLP-1 drug, has already gone generic, with one company currently selling it and others in the process of obtaining approval and launching their versions. Multiple companies are expected to launch generic versions of other GLP-1 drugs starting in 2026. To support this, India plans to incentivize local manufacturing of GLP-1 drugs under the Production Linked Incentive (PLI) scheme beginning in 2026. This move is prompted by the impending expiration of the patent on semaglutide, a key ingredient in popular drugs like Ozempic and Wegovy, in India by 2026.

Several Indian companies with a prominent presence in the US market are racing to launch generic versions of liraglutide in the US by FY26. Additionally, some Indian Contract Development and Manufacturing Organizations (CDMOs) have successfully secured contracts to supply GLP-1 drugs to Rest of the World (ROW) markets. This expansion into generics and international markets positions Indian companies to capitalize on the growing demand for obesity and diabetes treatments globally.

Sun Pharma, a leading Indian pharmaceutical company, is also making significant strides in the GLP-1 landscape. The company’s GLP-1 drug is expected to commence global phase 2 trials in 2025. In phase 1, it demonstrated a potentially differentiated profile in the evolving landscape of obesity treatment, thereby enhancing its potential competitive edge both domestically and internationally.

Asia’s healthcare sector presents a compelling landscape for investors, underpinned by robust demographic trends and rapid economic growth. The region’s aging population is driving unprecedented demand for a wide array of healthcare services, from pharmaceuticals and medical devices to cutting-edge technologies like telemedicine and AI-driven diagnostics.

Investors looking to capitalize on Asia’s healthcare boom will find numerous opportunities driven by sustained innovation, increasing healthcare infrastructure, and strategic government initiatives. We believe the region’s ability to address unmet medical needs and deliver high-quality, cost-effective healthcare solutions enhances its attractiveness on the global stage. As China and India continue to lead with their strengths in manufacturing and pharmaceuticals, complemented by the rise of ASEAN as a medical tourism hub, the potential for new areas of opportunity is plentiful and will only continue to evolve.

For sophisticated investors only. For informational purposes only. The information presented in the material is not and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP (“Shikhara”) is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.