Artificial Intelligence (AI) has rapidly transformed from a futuristic concept into a pivotal force reshaping industries worldwide. From automating simple tasks to powering sophisticated decision-making processes, AI’s impact so far is already undeniable. Yet, despite its rapid evolution, we are only beginning to scratch the surface of its potential. The broader adoption of AI is still nascent, and the landscape is ripe with untapped opportunities that will redefine how corporations, governments, and individuals operate.

As we stand on the cusp of this technological revolution, Asia emerges as a critical player—not just as a consumer of AI technologies but as a fundamental contributor to the AI ecosystem. To better understand these opportunities firsthand, our Senior Investment Analyst, Manish Nigam, recently traveled across Asia and met with over 25 companies across three markets. In this article, we delve into how Asian tech companies are not only benefiting from the AI trend but are also instrumental in building the infrastructure that will shape tomorrow, and we share key insights from what we learned on the ground.

When discussing the AI landscape, it’s impossible to overlook the significance of the Nvidia supply chain. For context, Nvidia has positioned itself in a pivotal role in AI development thanks to their specialized computer chips, i.e., graphics processing units (GPUs), that are essential for training Large Language Models (LLMs) like ChatGPT that form the core of the current generative AI (Gen-AI) driven wave.

While Nvidia has been instrumental in providing the computational power necessary for advancing AI applications, the backbone that supports Nvidia’s innovations lies heavily within Asia’s robust tech ecosystem. Companies like TSMC in Taiwan manufacture all of Nvidia’s advanced chips, while other firms, like South Korea’s SK Hynix, supply essential memory components.

These chips are then integrated into servers and server racks, which are designed/manufactured by Taiwanese companies such as Hon Hai and Quanta Computers, before eventually getting installed in major data centers operated by leading hyperscalers such as Microsoft, Google, Meta, and Amazon. In addition, multiple other components, including passive components and cooling solutions that are part of such servers and racks, are provided by a range of companies in Asia. This concentrated supply chain in Asia not only highlights the region’s technological prowess but also presents compelling investment opportunities across the entire AI ecosystem.

Viewing the AI investment landscape through this strategic lens reveals three distinct categories of opportunity. First are the infrastructure enablers – companies providing the fundamental building blocks like semiconductors, data centers, and networking equipment essential for AI development. Second, are the innovators creating consumer-facing AI devices and applications, from smartphones and laptops with AI capabilities to integrated smart home systems. The third category currently comprises professional services firms that bridge the gap between AI’s potential and practical implementation, helping businesses integrate and optimize AI solutions across their operations. This third category will further expand over the coming years to new and existing companies that launch consumer facing services fully leveraging the potential of AI and Generative-AI.

We believe each category presents unique investment opportunities, and in the following sections, we’ll examine each one in detail to reveal Asia’s dominance in these critical segments of the AI value chain.

At the heart of the AI revolution lies an enormous appetite for computing power and data processing. This foundational requirement drives massive investment in hardware infrastructure, from high-performance semiconductors to sophisticated cooling systems and data centers. As AI models grow increasingly complex, the demand for these core components continues to surge, mirroring the opportunity of investing in semiconductor companies during the early days of the personal computer revolution. Companies that provide these essential building blocks stand to benefit regardless of which AI applications ultimately prevail in the market.

Take TSMC, for instance, the world’s leading semiconductor foundry. With over 60% market share in global semiconductor manufacturing1 and a near monopoly share for the most leading edge nodes, TSMC produces some of the most advanced chips for companies like Nvidia, AMD, and Apple. Their commanding position in leading-edge semiconductor production – where they maintain a multi-year technological advantage over competitors – has translated into robust financial performance, with AI-related demand driving significant growth in their high-performance computing segment. And this dominance isn’t easily replicated. Building a competitive semiconductor fabrication plant requires not just tens of billions of dollars in capital investment but also decades of accumulated expertise and intellectual property.

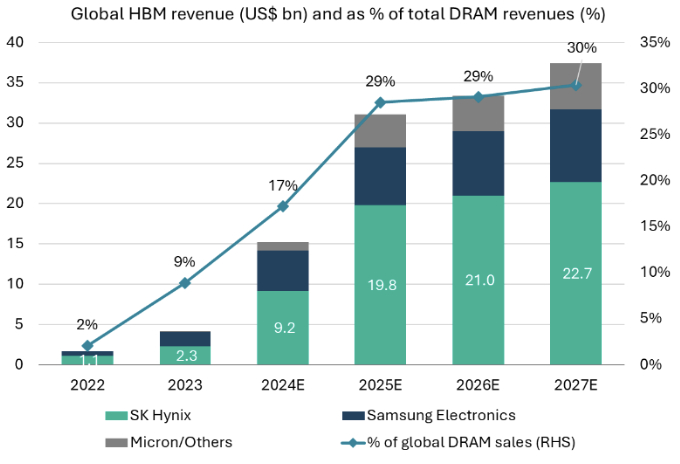

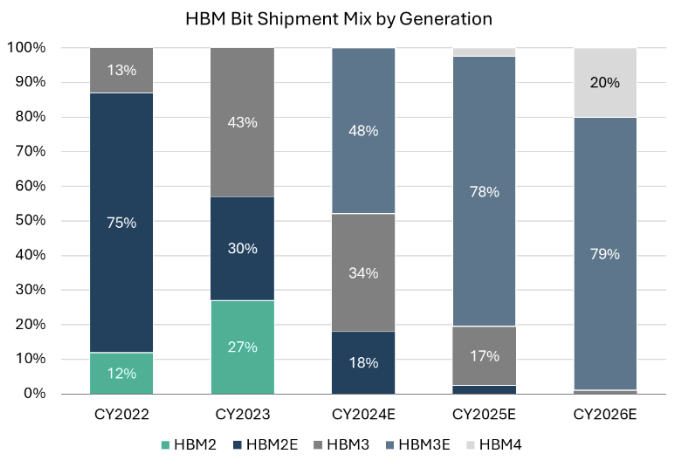

North of Taiwan, a similar moat exists in South Korea’s memory chip manufacturers like Samsung Electronics and SK Hynix. These companies, alongside Micron of the US, dominate the global market for high-bandwidth memory (HBM), a critical component that enables AI accelerators to process vast amounts of data at unprecedented speeds. For large-scale AI training, the industry has now moved to a preference for HBM3 technology, which can transfer data at speeds exceeding 800 GB per second.

Within this space, SK Hynix has established itself as a clear leader, becoming the sole supplier of HBM3 memory for Nvidia’s AI accelerators and maintaining a very high share through 2023. With the transition to more advanced HBM3e technology for Nvidia’s H200 chips in early 2024, SK Hynix again secured an early leadership position. This technological edge has translated into substantial financial benefits for the company, with HBM3/3e commanding prices 4-5 times higher than traditional DRAM and delivering significantly higher margins.2 Even as the industry moves toward next-generation technologies like 12-Hi HBM3e and HBM4 through 2025, we believe SK Hynix is well-positioned to maintain approximately 50% market share by value – notably higher than its historical 25% share in the broader DRAM market.3

Samsung Electronics, the traditional dominant player in the memory market, is trying hard to catch up with SK Hynix in HBM3e/4 in 2025, making this a fascinating space to watch.

The hardware requirements for AI extend beyond just chips. The data center industry is undergoing a fundamental transformation, transitioning from traditional CPU-based infrastructure to GPU-driven AI computing. This shift represents a step-change in market opportunity – while the conventional server market has historically hovered around US$100 billion annually, the widespread adoption of GPU-powered AI servers is expected to drive nearly threefold growth by 2026.4

Unlike traditional servers, these AI-optimized systems command premium prices due to their sophisticated configurations and enhanced computing capabilities. This dramatic expansion of the addressable market, coupled with strong visibility into deployment schedules by major cloud providers and enterprises, presents a compelling investment opportunity across the entire data center ecosystem.

We estimate that in 2025, around 80% of the AI servers based on Nvidia’s latest AI accelerator platform, Blackwell, will be manufactured by just two Taiwan-based companies, namely, Hon Hai Precision and Quanta Computers. These two companies have been amongst the largest assemblers and manufacturers of hardware equipment for several decades and have a global production footprint. A large pool of experienced engineers, exceptional design and process management expertise, ability to handle large-scale projects with short lead times, and having a solid balance sheet to be able to handle the working capital requirements, all add up to make these two companies exceptional among their global peer set.

Another such opportunity is Taiwan-based Delta Electronics – a global leader in power and thermal management solutions for data centers. During his research trip, Manish met with Delta’s management in Taiwan and identified several compelling attributes. With over 50% global market share in server power supplies, Delta has established itself as a crucial enabler of AI infrastructure.5 The company also has deep expertise in thermal management, which is particularly valuable as AI servers generate significantly more heat than traditional servers.

Delta provides both air and liquid cooling solutions, with their liquid-to-liquid cooling systems capable of handling up to 400kW of thermal load – approximately ten times the capacity of traditional liquid-to-air cooling methods.6 As data center operators increasingly adopt liquid cooling for their AI infrastructure, Delta’s early investments in this technology and their comprehensive solution set – from cold plates to coolant distribution units – position them well to capture value from this trend.

The few companies we’ve mentioned thus far are merely the tip of the iceberg. The AI hardware supply chain extends well across the region with companies like AVC and Auras, which develop specialized cooling solutions for high-performance computing environments, MediaTek’s ventures into AI-specific processors, and Wistron’s crucial role in AI hardware assembly, to name a few. What’s common among these companies is the powerful combination of technological leadership, high barriers to entry, and exposure to segments with surging AI demand. As the AI revolution accelerates, we believe these companies are well-positioned to benefit at the critical junctures of the supply chain. And that leads us to the next investment category.

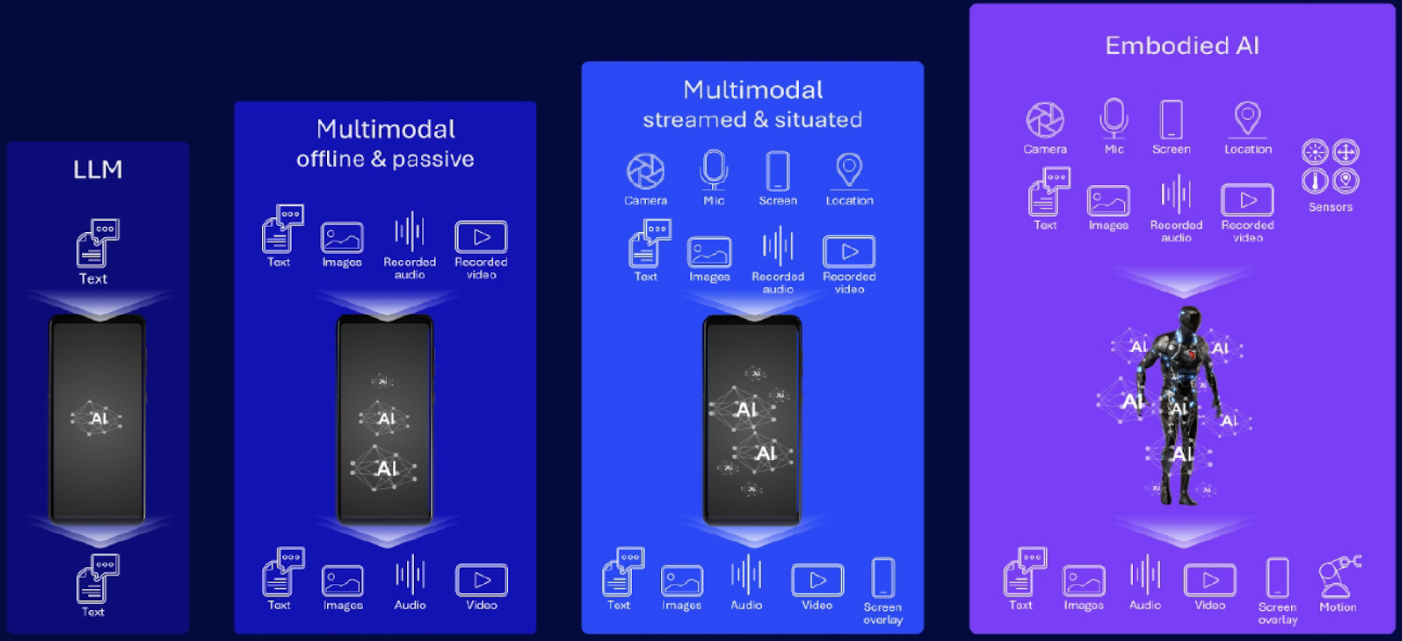

Once the infrastructure is in place, the next frontier is bringing AI capabilities to consumer devices. We’re seeing this transformation unfold across Asia’s technology landscape – for example, Samsung is integrating AI features into its Galaxy smartphones for real-time translation and photo editing, Apple is enhancing its devices with advanced AI intelligence to deliver personalized user experiences and smarter ecosystem interactions, MediaTek is developing specialized AI chips for mid-range devices, and Chinese laptop and smartphone makers are racing to implement their own AI solutions.

Supporting the integration of AI into devices is the shift from cloud-based to on-device AI processing. Having on-device AI processing offers several advantages, including reduced latency, enhanced privacy, and lower bandwidth requirements. The trend is driving significant investment in edge computing technologies, particularly in the development of power-efficient Neural Processing Units (NPUs) that can run AI models directly on devices.

MediaTek, a leading fabless chip design company, is a key player in this space. As one of the two biggest global suppliers of smartphone chips, it stands to gain from both the dollar content upgrade that will be required for the new generation of AI-enabled smartphones as well as from the likely replacement cycle as the existing base of smartphone users gradually convert to using new AI-rich phones over the coming years. The company is already seeing a rich upgrade cycle in 2024, with the revenue from its premium-end smartphone chip sales growing at a rapid clip.7

Chinese consumer tech giant Xiaomi is also aggressively integrating AI. While many tech companies are focused on singular AI products, Xiaomi is pursuing an ambitious strategy of embedding AI across its entire product portfolio. The company first unveiled its HyperOS operating system in October 2023, with HyperOS 2 just announced last month, designed to power AI features across its smartphones, smart home devices, and electric vehicles (EV). In smartphones, Xiaomi is developing on-device AI capabilities for improved photography, real-time translation, and personalized user experiences. The company’s latest flagship devices feature custom-designed NPUs to handle these AI workloads efficiently.

Beyond mobile devices, Xiaomi is leveraging AI to enhance its extensive “Internet of Things” (IoT) ecosystem, which includes everything from smart speakers to home appliances. These devices can now better understand user preferences and automate household tasks through AI-powered routines. Perhaps most ambitious is Xiaomi’s integration of AI in its recent EV debut. The company states it has developed an “end-to-end sensing and decision-making AI model” for automated parking, which allows for real-time observation and dynamic adjustment when parking in challenging scenarios.8 In sum, Xiaomi’s vertical integration across hardware and software, combined with its vast user base in emerging markets, positions it uniquely to deploy AI solutions at scale.

While consumer applications are the most tangible form of AI for the end user, the true transformative power of AI will be felt in how organizations implement and deploy these technologies. The business case for AI adoption is compelling – from automating routine tasks to generating sophisticated market insights, AI promises to enhance both process efficiency and cost optimization across any organization.

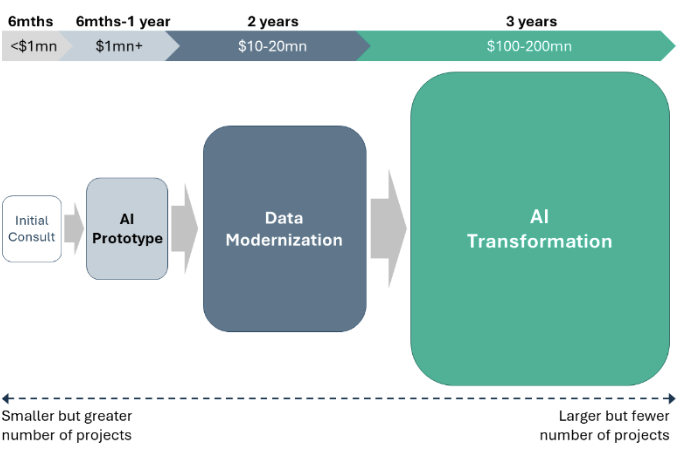

At a recent AI and IT conference, representatives from Accenture – a global leader in cloud – noted that AI adoption is accelerating at a pace that exceeds even the cloud computing revolution.9 One particularly interesting application mentioned is the conversion of legacy mainframe code to modern systems using generative AI, opening opportunities to modernize sectors that were previously considered too complex or costly to transform.

However, whether it’s modernizing legacy systems or deploying intelligent automation solutions, the journey from concept to implementation is complex, requiring extensive experimentation, proof-of-concept development, and thoughtful scaling of solutions. This is where IT services companies play a crucial role.

With the market for outsourced IT services in data and AI expected to reach US$200 billion by 2029, growing at an estimated 19.1% CAGR, leading IT services firms are positioning themselves as essential partners in the AI transformation.10 These firms are either developing their own enterprise-scale solutions or partnering with leading AI providers to create industry-specific implementations, effectively bridging the gap between AI’s potential and practical business applications.

Within this space, companies like Tata Consultancy Services (TCS), Infosys, and Cognizant are leading the way, leveraging their global scale and deep domain expertise to drive enterprise AI adoption. These companies bring several unique advantages to the table – they have decades of experience in IT services, a deep understanding of enterprise systems, and vast pools of skilled technology workers.

Infosys, one of India’s leading IT services firms, is at the forefront of enterprise AI implementation. The company has strategically upskilled a significant portion of its workforce in AI and machine learning, ensuring deep technical expertise. Infosys delivers tailored AI solutions that address specific industry challenges—for instance, deploying predictive maintenance systems in manufacturing to reduce downtime and implementing intelligent fraud detection in financial services. By partnering with top AI technology providers like Microsoft and Google, Infosys integrates cutting-edge capabilities into its offerings, enabling seamless AI-driven digital transformations for global enterprises. This focused approach has secured numerous AI projects, that should drive meaningful growth over the coming years as some of these projects move from proof-of-concept level to full implementation or commercialization.

Another example is Cognizant Technology Solutions. With a 30-year history in digital and technology services, Cognizant is now positioning itself as a leader in enterprise Gen-AI transformation. Through strategic partnerships with Microsoft, Google Cloud, and ServiceNow, Cognizant has developed key AI platforms such as Cognizant Neuro AI and Flowsource to accelerate enterprise AI adoption. The company also intends to leverage AI-related expertise to further solidify its position within the healthcare vertical, notably in the payer and provider solutions area.

Looking ahead, we see several trends that are likely to reinforce Asia’s position in the global AI ecosystem. Firstly, the demand for AI-specific semiconductors is expected to grow exponentially, strengthening the position of Asian manufacturers. Meanwhile, enterprise AI adoption is accelerating, creating opportunities for IT services companies to expand their implementation capabilities.

While initial excitement focused heavily on consumer applications, we think the immediate impact of AI is likely to be most profound in the enterprise space, where productivity gains and process improvements can be more readily realized and measured. The infrastructure supporting this transformation continues to expand, with major technology companies engaged in an unprecedented investment race in AI computing capacity that is expected to continue through 2026.

The challenge now lies in sustaining this momentum while addressing emerging needs – from developing specialized AI chips to ensuring responsible AI implementation. As AI becomes more pervasive, Asia’s technology ecosystem will play an increasingly important role in shaping how this transformative technology is developed, deployed, and utilized across the global economy.

For sophisticated investors only. For informational purposes only. The information presented in the material is not and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP (“Shikhara”) is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.