The lead-up to the 2024 Indian elections was marked by heightened volatility and market exuberance. Post the state elections, where Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) received favorable verdicts, market expectations soared. Exit polls further fueled optimism, leading to significant momentum in certain market segments, particularly in state-owned enterprises (SOEs) and defense stocks linked to government priorities. This momentum, however, became frothy, signaling potential risks.

Retail investor participation surged dramatically year-to-date, with local non-institutional flows tripling year-over-year to a substantial $7 billion per month by the end of May 2024.1 This direct retail participation in single stocks and derivatives trading heightened the risk of local flows unwinding, which we saw following the recent election results.

Contrary to widespread expectations, the 2024 election results delivered a surprising verdict compared to the exit polls. The BJP, which had secured a majority of 303 out of 543 seats in the 2019 elections, fell short of a majority this time, winning only 240 seats. The BJP-led National Democratic Alliance (NDA) coalition’s performance also declined, securing 292 seats compared to 353 in 2019. This unexpected outcome has shifted the focus to the coalition’s allies, particularly the Telugu Desam Party (TDP) and Janata Dal (United) (JDU), whose long-term but inconsistent support will be crucial in the coming months, especially with the upcoming state elections.

Initial assessments suggest that the BJP’s near 60-seat loss from the 2019 election can be attributed to local and non-economic issues. Key factors included the party’s lack of a strong voter base in the more developed Southern States and a loss of support in the populous Hindi heartland, particularly Uttar Pradesh, due to lingering soft economic conditions and local political issues.

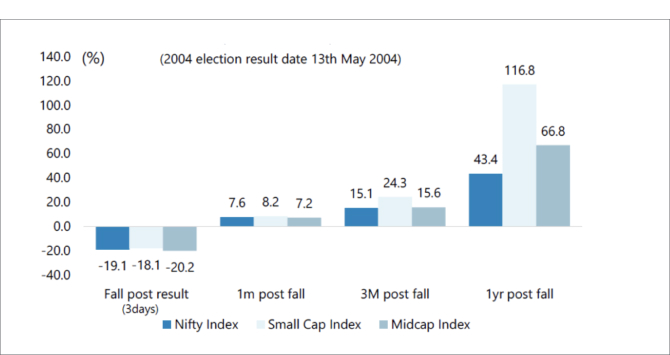

Historical parallels can be drawn to the BJP’s shock defeat in 2004, which saw the Nifty index decline by 19% in three days post-results, only to recover significantly in the following months as the nascent capex cycle gained strength.2 Similarly, the Modi government’s recent focus on initiatives such as the Production-Linked Incentive (PLI) scheme, infrastructure development, and corporate India’s capacity utilization improvements are yet to yield visible benefits. However, we expect these will contribute to job creation and economic growth over the next three to five years.

Despite the reduced majority, the continuation of BJP’s policy agenda remains likely, focusing on investment-led growth, capex, infrastructure creation, and manufacturing. We expect the impact on the economy to be limited, with GDP growth projected to remain within the 6.5-7.0% range.3 The underlying health of the economy and corporate balance sheets remains robust, supported by low debt-to-equity ratios, high capacity utilization, and PLI schemes. In sum, the BJP-led coalition’s economic objectives for 2024-29 will likely include:

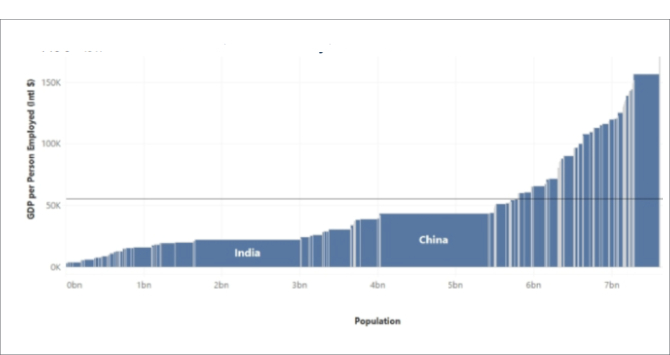

A key tailwind supporting India’s GDP growth outlook is productivity gains from a low base. Despite progress over the past decade, India’s GDP per hour worked remains significantly lower than global averages. However, with recent digital advancements and increased investment intensity, natural productivity improvements are expected, even without an absolute BJP majority.

Following the initial disappointment and anxiety around government formation, investor focus is expected to shift back to fundamental bottom-up stock picking. Sectors with overheated valuations, such as Industrials, Railways, Defense, and Public Sector Undertakings (PSUs), may see valuations moderate before becoming attractive again. We anticipate potential welfare spending and populist announcements by the coalition government in the July budget, supported by forecasted good monsoon rains, favoring the rural recovery theme.

Within the portfolio, we prefer sectors with high visibility of compounding in earnings/book available at ‘reasonable’ valuations. We continue to be overweight private sector banks, have booked gains in sectors like industrials and real estate, which saw sharp gains in recent months, while adding to high-quality consumption names.

In the near term, several key events will be crucial in shaping the market and economic outlook post-election:

While the election results were unexpected, we believe that the long-term economic trajectory of India remains intact. The government’s focus on investment-led growth, infrastructure development, and manufacturing, coupled with the inherent strength of the economy and corporate balance sheets, should continue to drive growth in the coming years. The absence of an absolute majority will provide the checks and balances needed for a healthy functioning of a democracy, temper down the euphoria of the domestic retail investors, and provide an attractive entry point for long-term institutional investors.

Overall, we remain positive on Indian equities, and expect a focus on fundamental, bottom-up stock picking and sectors with high earnings visibility at reasonable valuations will be essential for navigating the post-election market environment.

The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is a Registered Investment Adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara Investment Management’ investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.