Recently, our analysts, Saniel Chandrawat and Aditya Sharma, traveled across Mumbai and Bangalore to get a firsthand look at the companies driving India’s economic momentum. This trip provided invaluable insights and a deeper understanding of the local market dynamics. Here, we share some of our observations and experiences from the journey, highlighting some of the companies we believe are poised for significant growth in the coming years.

Our two-day visit to Bangalore left us optimistic about India’s manufacturing scale-up and robust consumer spending trends. Bangalore, often referred to as the Silicon Valley of India, is a hub of innovation and technology. One striking observation was the rapid digitization permeating various sectors, a testament to India’s commitment to embracing digital transformation.

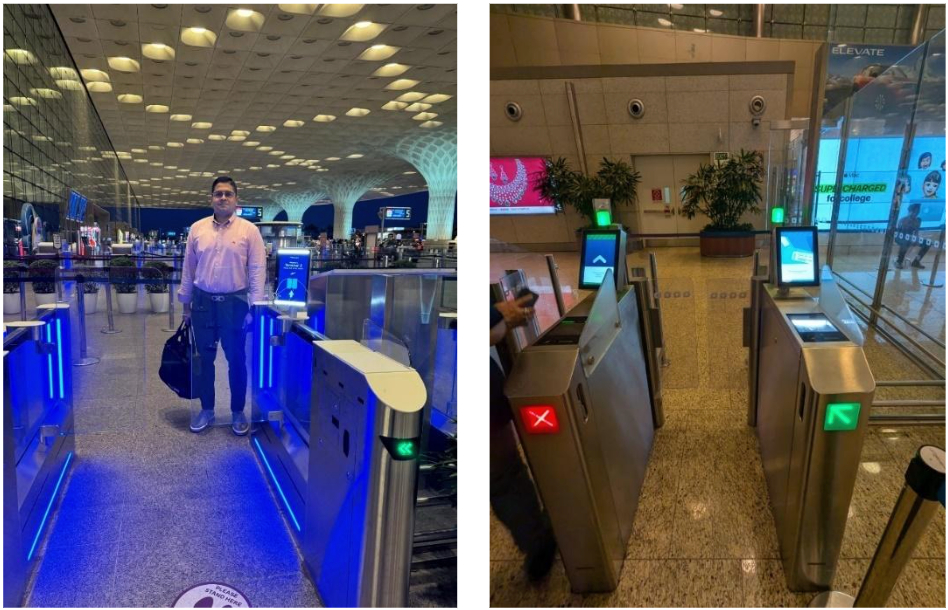

One of the standout examples of this digital integration is the ‘Digi Yatra’ initiative (i.e., Digital Travel). Coordinated by the Civil Aviation Ministry, Digi Yatra aims to revolutionize air travel using facial recognition technology (FRT). This initiative enhances passenger experience and aligns airport operations through biometric authentication and digital identities.

Our analysts experienced the seamless processes firsthand during their travel from Mumbai to Bangalore. From quick check-ins to biometric-based boarding, the efficiency and security enhancements were evident. The initiative, currently implemented at 13 airports with plans to expand to 114 more, stands as a testament to India’s forward-thinking approach.

Our visit to Aurika, Mumbai Skycity, was a significant highlight of the trip. Lemon Tree Hotels, known for its mid-scale and economy accommodations, has ventured into the upscale and luxury segment with the launch of Aurika in 2019. Our analysts visited Aurika, Mumbai Skycity, the third and latest property under this upscale brand. This project represented a significant capital expenditure for the company, making its success crucial.

Our analysts were impressed by the property’s strategic location near Mumbai Airport, making it particularly attractive for business travelers. The rooms were spacious and well-appointed, with elegant, modern bathrooms typical of a five-star establishment. What stood out was the management’s focus on operational efficiency. Despite being a luxury offering, they’ve maintained a lean staff-to-room ratio of 0.8, compared to the industry standard of 1.251, without compromising on service quality. The hotel’s emphasis on sustainability was also noteworthy, with features like solar power reducing operational costs. These efficiency measures, combined with the growing demand for premium accommodations, position Aurika for strong financial performance.

From an investment perspective, Lemon Tree Hotels presents an exciting opportunity. The company’s expansion strategy, focusing on both metro and non-metro locations, coupled with its cost-cutting measures and improving operational leverage, sets the stage for robust growth. As of March 2024, Lemon Tree Hotels has 104 operational hotels under its group, with another 62 hotels in the pipeline to be launched in the next 3 to 5 years2. As Lemon Tree continues to achieve critical mass, we anticipate that its business growth will generate its own momentum, further enhancing its market presence and operational scale in India’s hospitality market.

Our visit to Sansera Engineering’s plant in Bangalore was eye-opening. With a rich history spanning more than 40 years, Sansera Engineering has established itself as a leading Indian precision engineering company, manufacturing high-quality components for the automotive, aerospace, and non-automotive sectors. In the last five years, Sansera has significantly expanded its global footprint, securing contracts with industry giants like Tesla and Boeing, showcasing its growing prominence in the global high-precision component market.

During their visit, our analysts were impressed by Sansera’s in-house machine-building capabilities. The company develops 60-70% of its machines in-house, tailored to meet specific production requirements. This self-reliance not only reduces costs significantly but also shortens lead times and enhances productivity, positioning Sansera favorably against its competitors.

An exciting aspect of Sansera’s operations is its venture into aluminum forging, driven by the rising demand for electric vehicles (EVs) and premium two-wheelers. While aluminum casting is more straightforward, forging offers superior strength, making it ideal for high-performance applications. Despite initial high rejection rates due to the challenging nature of aluminum, Sansera is making significant strides. The company’s fully integrated in-house capabilities, from design to anodizing, enhance its competitive edge.

The aerospace division was another highlight of our visit. With a growing product repository of 1,200 parts and direct supply relationships with major players like Boeing, Sansera is establishing itself as a formidable player in this high-precision, high-value segment. This is also part of the company’s plan to actively diversify its portfolio to reduce dependence on internal combustion engine (ICE) vehicles, which currently constitute 76% of its sales3. By expanding into tech-agnostic auto segments, EV components, and aerospace, Sansera is positioning itself for more sustainable growth over the longer term.

Finally, it’s worth noting the significant export opportunity, driven in part by the shift of OEMs away from European suppliers due to higher costs. Sansera has been capitalizing on this trend, with 64% of the company’s order book coming from international clients as of FY244. The company has been successful in adding high-profile customers like Ford, Cummins, and Tesla.

From an investment standpoint, Sansera’s diversification strategy, coupled with its strong global order book, makes it an attractive proposition. Overall, we believe the company’s ability to adapt to changing market dynamics while maintaining a focus on operational excellence positions it well for sustainable long-term growth.

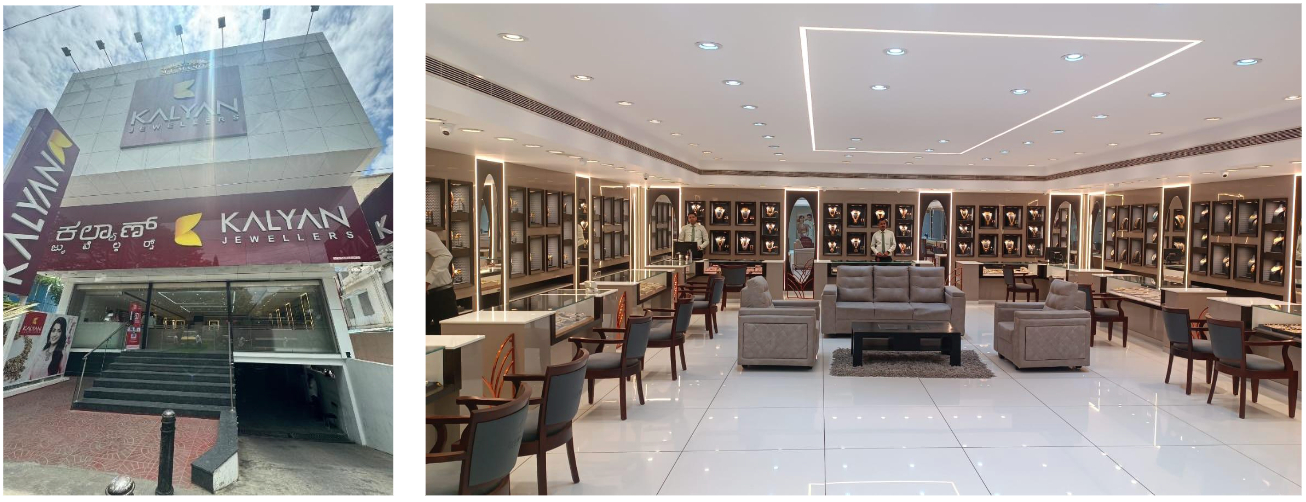

Founded in 1993, Kalyan Jewellers has grown into one of India’s largest and most recognized jewelry brands, specializing in an extensive range of gold, diamond, and other precious jewelry. Inspired by the success of Titan, we see Kalyan emerging as the next leading player, gaining share from unorganized players as it expands its footprint across India. Since its IPO in 2021, we’ve keenly observed its impressive expansion efforts, which include 16 showrooms in Karnataka state alone.

Our analysts visited Kalyan’s Dickenson Road branch, near Ulsoor Lake – a spacious 10,000-square-foot showroom spread over three floors. Located in a bustling area with numerous jewelry stores, Kalyan distinguishes itself through its range of designs and exceptional service. This commitment to quality is evident in the high percentage of repeat customers the store enjoys, as mentioned by the store manager during our visit.

This particular showroom delivered robust revenues of Rs 2 billion (~USD 24 million) in FY24, and the store has consistently grown at a compound annual growth rate (CAGR) of 15% over the last five years5. We were impressed by Kalyan’s strategic use of ‘My Kalyan’ branches – smaller formats that act as customer acquisition channels, contributing 25% to the store’s revenue.6 This innovative approach to customer outreach and the company’s focus on design and service quality set it apart in a competitive market.

From an investment perspective, Kalyan Jewellers represents an exciting opportunity to participate in the formalization of India’s jewelry sector. The company’s aggressive expansion plans, including 80 new franchisee showrooms in FY257, should position it well to capitalize on the growing demand for branded jewelry among India’s rising middle class.

Our inaugural research trip has reaffirmed our belief in India’s growth story. From the digital revolution transforming air travel to the evolution of traditional sectors like hospitality and jewelry, we see numerous opportunities for long-term value creation. As Shikhara continues to explore and invest in India’s dynamic market, we remain committed to identifying companies that are not just benefiting from but also driving India’s economic transformation. The energy and innovation we witnessed on the ground have only strengthened our conviction in India’s potential as an investment destination.

The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is a Registered Investment Adviser with the U.S. Securities and Exchange Commission. This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara Investment Management’ investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.