2025 has kicked off with pivotal economic and policy shifts in India, presenting both challenges and opportunities for investors. Despite the ongoing market pullback, signs indicate a bottoming trend, which increases our optimism for a rebound in the coming months. Successfully navigating this landscape requires deep insights, a seasoned team, and a strategic approach. In this month’s report, we assess the implications of the FY26 Union Budget, evaluate recent corporate earnings, and share our latest views and some photos from on the ground in India.

The MSCI India Index declined 3.53% (in USD terms1) in January, lagging regional peers amid mixed corporate earnings and a cautionary pre-budget sentiment. Foreign institutional investors (FII) turned net sellers of Indian equities in January, with net outflows of ~USD 9.0 billion erasing the USD 1.8 billion of net inflows in December.2 Sector-wise, Energy and Consumer Staples were the top performers, while Real Estate and Health Care were the laggards.

Key macroeconomic indicators during the month remained robust, with some beginning to pick up pace: central government capex surged to INR 1.7 trillion in December (up 95.3% y/y), versus a monthly average of INR 640 billion from April to November 2024.3 Goods and Services Tax (GST) collections reached INR 1.96 trillion (~USD 22.4 billion) in January, their second-highest level, growing 12.3% y/y (vs 7.3% y/y in December).4 Manufacturing PMI hit a six-month high of 57.7 in January, driven by strong export orders, while services PMI, though moderating to 56.5 (vs 59.3 in December) remained firmly in expansion territory.5

Meanwhile, inflation is showing signs of stabilizing but remains a key point to watch. Headline consumer price index (CPI) softened to 5.2% y/y in December (vs 5.5% in November), remaining steady for the second consecutive month on a seasonally adjusted basis of 0.3% m/m. The moderation is helped by a gradual disinflation in food prices, especially vegetables, which weighed on the consumption basket last year.

The Union Budget, presented on February 1, prioritized fiscal consolidation while maintaining a growth focus. Though capital expenditure targets were modest, the budget supports consumption through income tax relief while maintaining the status quo on capital gains and corporate taxes.

The government’s FY2025-26 budget strikes a careful balance between fiscal consolidation and growth stimulus. The framework demonstrates continued commitment to fiscal prudence while introducing targeted measures to boost middle-class consumption. Some key takeaways from the announcement:

Overall, we view the budget as positive, as it provides tax relief for middle-class consumers, strengthening household balance sheets while boosting discretionary spending – particularly in the travel and housing sectors, which carry strong multiplier effects throughout the economy.

However, while the budget signals potential tailwinds for Indian consumption stocks, we maintain a selective approach given the competitive intensity that remains across segments. In categories like quick-service restaurants and quick commerce, market leaders are pursuing aggressive expansion plans, and we continue to watch the potential impact on margins. Companies that can execute efficiently while building strong brand loyalty will emerge as the winners in this high-stakes battle for consumer mindshare.

On the flip side, while markets initially reacted negatively to the plateau in central government capex, viewing it as a headwind for industrials and infrastructure, several factors suggest a more nuanced outlook. In our view, multiple growth drivers remain: state governments and PSUs are expected to increase their capex, private sector utilization is still high at ~80%, and Indian industrial companies have successfully integrated into global sourcing networks. Therefore, we view this market pullback as an opportunity to increase exposure to industrials at more favorable entry points.

Earnings in India for Q3FY25 (quarter ending December 2024) so far have been mixed but in line with expectations. While industrials, large banks, and tech names have shown resilience, consumption remained subdued.

ICICI Bank, for example, delivered strong earnings despite the tough macro environment. Compared to peers, ICICI Bank delivered superior loans/deposit growth (in particular CASA), maintained relatively stable margins, and sustained consistent asset quality throughout the quarter.

Overall, we expect things to improve for banks from here. The banking sector bore the brunt of FII selling and also felt the pressure on net income (NI) growth as they sought to scale back their unsecured loan exposures. However, as the situation normalizes, we expect net interest margins (NIMs) will stabilize, with net interest income (NII) growth approaching 15% and earnings growth of ~15-18% annually.

In the consumption sectors, Q3 earnings clearly reflected a slowdown as consumers continued to feel the pinch from rising prices, particularly impacting FMCG and non-essential categories such as quick service restaurants (QSR), paints, and quick commerce. Despite these challenges, certain companies have continued to excel.

For example, MakeMyTrip, India’s largest OTA, has performed well amid concerns about a slowdown in consumer discretionary spending, though the travel vertical has shown growth. The company reported revenue growth of 26.8% y/y for the December quarter, driven by record hotel check-ins during the peak holiday season.6 Moreover, despite increasing competition from supplier direct channels, MakeMyTrip has been able to defend its market share, all while pursuing new strategic investments and improving margins through disciplined cost management.

For the broader consumer landscape, tax savings of approximately INR 1,000 billion are set to enhance consumer spending power. We expect to see higher spending on both essential goods like FMCG, groceries, and personal care products, as well as discretionary items such as QSR, jewelry, fashion, and more premium products. However, as aforementioned, competitive intensity remains a key factor to watch.

High real rates appear to be achieving their desired effect in the US, as COVID-era excess savings have now been depleted. Softening hiring data and declining service PMIs indicate a slowdown in the US economy, and along with moderate tariffs, these factors are likely to lead to a peak in the US dollar and interest rates. Additionally, given the elevated US market valuations, investor sentiment may increasingly question American exceptionalism over the next 6-9 months. Consequently, we expect investors will increase allocations to Asian and emerging markets, which are currently trading at a 30-year discount to their developed market peers and at their most attractive levels in years.

On tariffs, we believe that financial markets serve as a crucial feedback mechanism for policymakers, effectively constraining extreme policy decisions by creating negative market reactions that force course corrections. We saw this in India, where recent market pullbacks encouraged some relief in income tax and no increases to corporate tax or Capital Gains Tax (CGT). The same market-driven moderation will likely play out in current US-China tensions. Unlike Trump’s first term, today’s inflationary environment makes aggressive trade measures a politically risky move. Substantial tariffs would strengthen the dollar and undermine the US’s reshoring ambitions. Thus, as we’ve postulated since October, the use of aggressive tariffs is unlikely to materialize.

Recent signals support this view: the 10% tariff on China announced on February 1 was a lot milder than markets expected, while China’s response was also very tame. It’s clear that both parties are keeping room for negotiation, and soundbites are indicating both sides are maintaining dialogue, which we expect will move towards a deal. Thus, our overall stance on tariffs is that they will be moderate and manageable through ongoing negotiations.

For India, the current market pullback, which now runs into its 5th month, is showing signs of bottoming. The Reserve Bank of India’s (RBI) recent 25bps rate cut on February 7th marks the beginning of a dovish pivot, with expectations of an additional 25-50bps reduction over the next six months. This monetary easing cycle should provide a tailwind for economic growth and market sentiment, encouraging renewed investments.

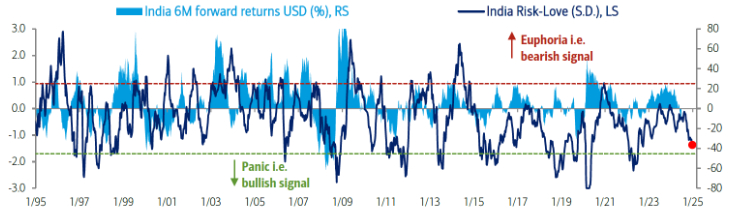

The current decline matches typical patterns we’ve seen over the past decade and is well-illustrated in BofA’s India Risk-Love chart below. Market valuations have returned to reasonable levels after the recent correction, creating attractive entry points. With key events like the budget and the RBI’s credit policy now announced, we expect markets to rebound in the near future.

In January, our Senior Investment Analyst, Saniel Chandrawat, visited India to engage with key corporates and conduct comprehensive channel checks. Here are some of his observations from the ground:

Nascent but growing EV market: A significant highlight from Saniel’s discussions was Mahindra and Mahindra’s upcoming electric vehicle (EV) launches. The company is set to introduce two SUV models equipped with advanced features and a futuristic design, which has generated substantial customer interest in showrooms. This enthusiasm reflects the broader trend in India’s passenger vehicle market, where government incentives and premiumization are beginning to drive a robust shift towards EV adoption

Slow retail traffic: During his channel checks, Saniel noted that the retail sector is grappling with weak footfall despite a robust presence of store offerings. In the fast fashion segment, stores showcase a wide array of trendy designs at highly affordable prices—denim jeans priced around USD 10-11 per piece, tops between USD 4-8, and footwear ranging from USD 4-5. While these attractive pricing strategies and diverse selections highlight the competitive intensity within the sector, overall consumer traffic remains subdued.

Trent, an Indian retail company under the Tata Group, operates a diverse portfolio of brands including Westside, Zudio, and Star Bazaar, specializing in fashion, lifestyle, and grocery segments. Saniel’s store visits to Zudio outlets highlighted their competitive fast fashion strategy, which directly competes with Reliance Trends stores owned by Reliance Retail.

India’s GLP-1 potential: Saniel met with Dr. Reddy’s Head of Emerging Markets and gained valuable insights into the company’s strategic preparations for their upcoming GLP-1 launch in key regions as the patent is set to expire in March 2026. Dr. Reddy’s boasts end-to-end capabilities, including active pharmaceutical ingredient (API) production, formulations, and fill and finish, giving them a significant edge amid the global capacity shortage. With many Indian companies seeking their GLP-1 APIs, Dr. Reddy’s strong market presence ensures they can meet high demand while competitors may struggle. Additionally, their leading position in emerging markets outside India sets them up to capture substantial market share post-patent expiry.

For sophisticated investors only. For informational purposes only. The information presented in the material is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This material doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

This material is prepared by Shikhara Investment Management LP (“Shikhara”). This material does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this material are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements.

Certain information contained in this material is compiled from third-party sources. Whereas Shikhara has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, Shikhara takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this material. Neither Shikhara nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this material are prepared and maintained by Shikhara and has not been reviewed by the Securities and Exchange Commission of the United States.

The Fund managed by Shikhara may or may not hold all of, or some of the securities mentioned in the article.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.

This website is published exclusively for the purpose of providing general information about the management services carried out by Shikhara Investment Management LP, Shikhara Capital (Hong Kong) Private Limited and its affiliates (collectively “Shikhara Investment Management” or “Shikhara”). The information presented on the website is not, and may not be relied on in any manner as legal, tax, investment, accounting, or other advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment product or any other entity sponsored or managed by Shikhara Investment Management. This website doesn’t constitute and should not be considered as any form of financial opinion or recommendation.

Shikhara Investment Management LP is currently an Exempt Reporting Adviser that is exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission and Shikhara Capital (Hong Kong) Private Limited has been approved by the Hong Kong Securities and Futures Commission. This website does not constitute an offer to sell or the solicitation of an offer to buy in any state of the United States or other U.S. or non-U.S. jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction.

Investment involves risk. Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the investment product will generate a return and there may be circumstances where no return is generated. Investors could lose all or a substantial portion of any investment made. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the investment product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Shikhara’s investment products are suitable only for sophisticated investors and require the financial ability and willingness to accept the high risks and lack of liquidity inherent in Shikhara’s investment products. Prospective investors must be prepared to bear such risks for an indefinite period of time. No assurance can be given that the investment objectives of any given investment product will be achieved or that investors will receive a return of their investment.

Certain of the information contained in this website are statements of future expectations and other forward-looking statements. Views, opinions, and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance, or events may differ materially from those in such statements.

Certain information contained in this website is compiled from third-party sources. Whereas Shikhara Investment Management has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, Shikhara Investment Management takes no responsibility for the accidental publication of incorrect information, nor for investment decisions taken based on this website. Neither Shikhara Investment Management nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and nothing contained herein should be relied upon as a promise or representation as to past or future performance of any investment product or any other entity.

The contents of this website are prepared and maintained by Shikhara Investment Management and has not been reviewed by the Securities and Exchange Commission of the United States or the Securities and Futures Commission of Hong Kong.

The Shikhara logo and name are trademarks of Shikhara Investment Management LP, registered in Hong Kong, the People’s Republic of China (PRC), Australia, the United Kingdom and the European Union and pending registration in the United States.